- •

MetaMask now lets you trade PERPS directly inside the mobile wallet, powered by Hyperliquid’s on-chain engine, with access to 150+ markets and up to 40x leverage. - •

Funding is simple because any EVM token is auto-converted to USDC on Arbitrum, removing the need for external bridges, extra swaps, or separate trading accounts. - •

Perp trading carries real risk, so monitoring margin, liquidation price, and TP/SL levels is essential before opening or closing any leveraged position.

MetaMask Perps Trading brings perpetual futures directly into the MetaMask mobile wallet, giving users a simple way to open leveraged long and short positions without leaving their Web3 setup. It’s a simple setup, but since leverage and on-chain execution can feel overwhelming at first, having a clear guide makes things easier. This walkthrough explains how the feature works, how to fund your account, and how to manage positions safely, all in straightforward language that helps you understand the entire flow with confidence.

How MetaMask Perps Trading Works

MetaMask Perps Trading is built to feel familiar even if you’ve only used the wallet for basic swaps in the past. Behind the scenes, MetaMask uses Hyperliquid’s on-chain trading technology to route and execute every order. This means trades settle on-chain, your funds remain self-custodied, and you don’t need to create or link an external exchange account.

You can start with any EVM-compatible token: ETH, USDT, mUSD, BNB, or others. MetaMask automatically converts the token into USDC on Arbitrum when you fund your Perps balance. There’s no extra MetaMask swap fee for this conversion. You only pay a small network fee and then your margin balance appears instantly inside the Perps tab.

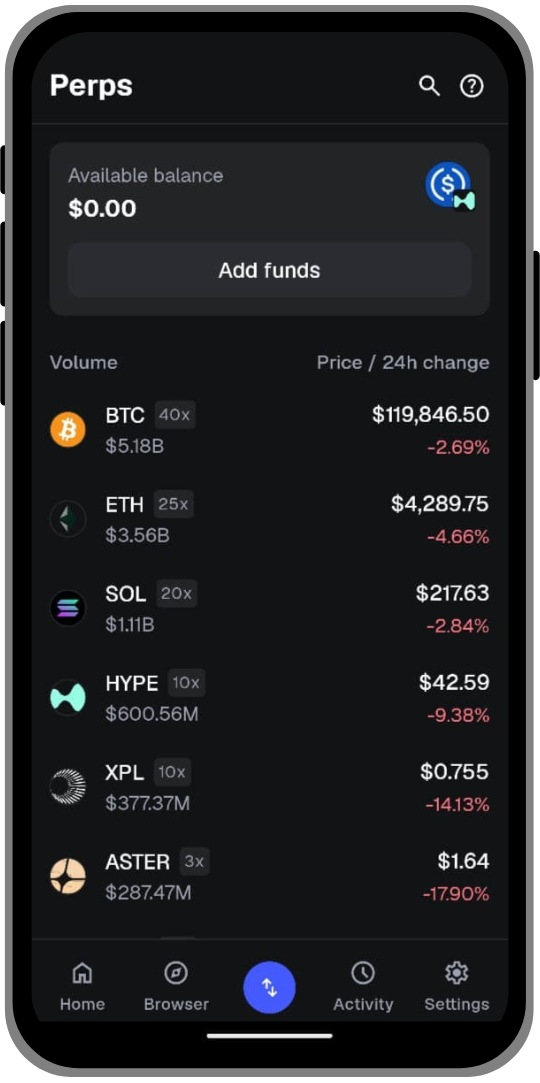

Once funded, you can access 150+ markets, trade with up to 40x leverage, and use common order types like market and limit. All orders follow Hyperliquid’s fee structure: 0.015% maker and 0.045% taker. Everything remains inside your MetaMask Mobile app, which keeps the experience simple, clean, and accessible.

Because the feature is fully native to the wallet, you don’t have to manually bridge funds, handle chain selection, or switch platforms. That’s where much of the convenience comes in, especially for traders who prefer to keep the entire flow inside one environment.

If you need USDC to fund MetaMask Perps Trading, the easiest option is buying USDC on a centralized exchange like Bitunix and withdrawing it directly to your MetaMask wallet. Once the funds arrive, you can load them into your Perps balance instantly.

Step-by-Step: How to Trade PERPS on MetaMask

The trading interface is designed for the MetaMask Mobile app, so make sure you’re using the latest version before you begin.

How to Monitor or Close Your Position on MetaMask Perps

MetaMask Perps provides a simple, clear dashboard for tracking your open trades.

What Are MetaMask Perps?

Perpetual futures, commonly called Perps, are crypto derivatives that let traders long or short an asset without an expiry date. They’re flexible because you can hold a position for minutes or months, depending on your strategy.

MetaMask brings this entire experience into the wallet itself. You can trade more than 150+ tokens, access leverage, use limit or market orders, and manage your trades in one place.

For users who want to trade PERPS on MetaMask without dealing with external exchanges or complex bridges, this integration creates a seamless flow. And if you want a deeper look at how MetaMask works overall, from security to swaps and network support, you can explore our full MetaMask wallet review to get a complete understanding before you start trading.

Key Features of MetaMask Perps

- Fast execution: On-chain settlement through Hyperliquid ensures quick and reliable execution.

- Full self-custody: Your funds never leave your MetaMask wallet.

- Simple funding: Any EVM token is auto-converted to USDC on Arbitrum with no extra swap fee.

- Charting tools: Built-in TradingView charts give you clear market visibility.

- 150+ markets: Access a wide selection of tokens with margin support.

Bottom Line

MetaMask Perp trading requires caution, and it’s always important to stay aware of the risks that come with leverage, liquidation, and volatile markets. But the new feature makes it easier to trade PERPS on MetaMask directly inside your web3 wallet, which removes the usual confusion around bridges and external swaps. Everything stays in one place, which brings a layer of convenience that many traders will appreciate.

Since you’re now keeping active trading funds inside MetaMask, it’s worth taking a moment to learn proper wallet safety. You can continue with our complete guide on how to secure and back up your MetaMask wallet, so your assets stay protected while you explore this new feature with confidence.

FAQs

1. What are the fees for trading on MetaMask Perps?

MetaMask Perps uses Hyperliquid’s on-chain fee structure. Maker orders cost 0.0150 percent, and taker orders cost 0.0450 percent. There are no additional MetaMask swap fees when you fund your Perps account.

2. Can I trade with any token in my MetaMask wallet?

Yes, any EVM-compatible token can be used to start trading. MetaMask automatically converts it into USDC on Arbitrum when you add funds to your Perps balance.

3. Is perpetual trading on MetaMask safe?

MetaMask Perps operates through self-custody, so you remain in control of your funds at all times. However, perpetual futures involve leverage, liquidation risk, and price volatility, so it is important to start small and manage risk carefully.

4. Can I withdraw my margin balance anytime?

Yes, you can withdraw your Perps margin balance back to your main MetaMask wallet anytime. Once withdrawn, the funds return as USDC on Arbitrum, and you can swap or bridge them as needed.