Finding a good exchange where you can trade cryptocurrencies and withdraw funds without the waistline of KYC verification is necessary. We have taken on the task of reviewing several exchanges that provide trading services with no KYC required and have selected the best non KYC crypto exchanges for you to choose from.

If you wish to find an exchange where you can preserve your identity, and still be able to perform transactions, then this guide is for you. All the exchanges provided do not require KYC to start trading, depositing, or withdrawing.

What are the best no KYC exchanges

We have drawn a list of the best among the No-KYC exchanges that are available on the market and will review them for you to have a better judgment to make your choice. Our review will highlight relevant features such as the fee structure, payment methods, security, pros and cons, and overall services.

Let’s take a look at the best No KYC exchanges:

| Exchange | Spot Fees (M/T) | Futures Fees (M/T) | Number of Coins | KYC Required |

|---|---|---|---|---|

| 1. Bitunix | 0.1% / 0.1% | 0.02% / 0.06% | 317+ | No |

| 2. Blofin | 0.1% / 0.1% | 0.02% / 0.06% | 394+ | No |

| 3. BingX | 0.1% / 0.1% | 0.02% / 0.05% | 824+ | No |

| 4. Phemex | 0.1% / 0.1% | 0.01% / 0.06% | 355+ | No |

| 5. BYDFi | 0.0% / 0.1% | 0.02% / 0.06% | 418+ | No |

| 6. Hyperliquid | 0.01% / 0.03% | 0.01% / 0.03% | 132 | No |

| 7. Margex | N/A | 0.01% / 0.06% | 240+ | No |

| 8. dYdX | N/A | 0.02% / 0.05% | 66 | No |

| 9. CoinEX | 0.2% / 0.2% | 0.03% / 0.05% | 1000+ | No |

| 10. Jupiter | 0.1% / 0.1% | 0.1% / 0.1% | 1000+ | No |

| 11. Changelly | 0.25% / 0.25% | 1% | 700+ | No |

| 12. ApeX | N/A | 0.02% / 0.05% | 230+ | No |

| 13. PrimeXBT | N/A | 0.01% / 0.02% | 110+ | No |

| 14. BTCC | 0.1% / 0.1% | 0.045% / 0.045% | 88+ | No |

1. Bitunix

Bitunix stands as the overall best no-KYC exchange, with features that make it no different from some of the standard platforms. Bitunix is a crypto derivatives exchange that was founded in 2021 and is based in Hong Kong. The exchange currently has a daily trading volume of $1.2 billion in spot and $7.7 billion in futures, making it one of the most active crypto exchanges.

With 300+ cryptocurrencies for users to select from, Bitunix provides a user-friendly platform with a good number of products and services available. The platform is also widely celebrated for its trading interface for both spot and futures traders with up to 125x leverage on trades. It also offers USDT-margined perpetual futures as the major derivatives trading product.

Bitunix is an exchange that is recognized worldwide with 1 million+ users around the globe. The exchange is commended for its standard fees also. It charges a minimal fee of 0.06% and 0.02% taker and maker for futures trading, and a 0.1% maker/taker fee for spot trading.

Users can access some of the most common blockchain networks via the platform, including the Solana network, Binance coin BEP20, and Tron TRC20 networks from which users can easily make withdrawals unto their wallets.

Bitunix offers a low range of payment methods for customers like credit/debit cards, Fatpay, Coinify, Apple Pay, and bank transfers.

Additionally, there are welcome bonuses available to new users on Bitunix up to $5,500 based on trading activity.

2. Blofin

Blofin is a centralized cryptocurrency exchange that offers users a quality where they can trade futures. The platform is also highly recognized for its no KYC feature, which allows users to begin trading assets without having to input personal data.

Founded in 2019, Blofin is a secure no-KYC exchange where users can trade perpetual futures. However, it recently added a spot feature, as well as a Copy trading feature for customers to enjoy, with access to 300+ trading pairs. The exchange has a daily trading volume of $12.6 billion for futures trading.

The Blofin exchange has integrated a user-friendly trading platform for both beginners and expert traders to navigate. It also provides users with advanced trading software such as advanced order types, trading tools, and live charting tools.

Blofin trading fees are according to the industry standard. For spot trading, a fee of 0.01% is incurred for both maker and taker, while for futures, the maker and taker fee is 0.02% and 0.06%.

3. BTCC

BTCC is among the oldest cryptocurrency exchanges around, founded way back in 2011. The cryptocurrency exchange is among the most enduring on the market and garnered a platform with 1 million registered users worldwide.

BTCC supports spot and futures trading but is mostly known for futures. It currently has a 24-hour volume of $9 billion in futures. Among other things, the exchange prides itself in its secure platform, with no form of security breach in the last decade, since its inception.

BTCC offers a user-friendly platform where users are free to begin trading without KYC but with several restrictions to their accounts.

BTCC offers two account types, the beginner and the experienced account, upon registration. Users who have more experience are welcome to sign up for an experienced account with wider trading tools. It also offers some of the lowest fees for its futures trading platform and does not distinguish maker and taker fees, standing at 0.1%.

Additional features on BTCC include a copy trading platform, welcome bonuses to new users up to $1000, up to 225X leverage, and a demo trading platform.

4. Phemex

Phemex is the best non-KYC exchange for beginners to build a crypto career. If you are a beginner looking to start without having to go through the hurdles of KYC verification, then Phemex is the right exchange for you.

Phemex is a crypto derivatives exchange based in Singapore and was founded in 2019. The exchange gained rapid attention due to its low fees, no KYC, and user-friendly interface for trading and wallets. The exchange also offers trading in spot, contract, and margin trading.

With 5 million active users in over 200 countries, Phemex has a daily trading volume of $130 million for its spot market and $1.1 billion for derivatives. There are over 250 assets, 277+ contract trading pairs, and 300+ spot trading pairs.

The trading interface is easy for newbies to navigate and is laced with tools for accurate trading analysis. Leverage up to 100x can be used by traders. Leverage trading for perpetual contracts such as ETHUSD, BTCUSD, LTCUSD, LINKUSD, XRPUSD, and XTZUSD is provided by Phemex.

For trading fees, Phemex charges a 0.1% maker/taker fee for spot trading, while contract trading incurs a 0.01% and 0.05% maker/taker fee.

Payment methods on Phemex include bank transfer, credit/debit card payment, and third-party payments. No KYC users can make withdrawals of up to 2 BTC per day.

5. BingX

If you are looking for a great no KYC BingX is the right option for you. It is one of the best No KYC exchange for high leverage derivatives trading.

Founded in 2018, BingX is a derivatives exchange based in Singapore. The exchange has risen to global standards, and now possesses offices in other regions EU, Canada, Hong Kong, and others. BingX currently boasts a user base of 10 million registered customers worldwide and is present in over 100 countries.

With an easy-to-navigate platform, BingX offers users 350+ cryptocurrencies to trade, with a smooth interface for trading spots or futures. BingX currently has a daily trading volume of $489 million for spot and $7 billion for futures.

Users of BingX can trade with flexibility and benefit from sophisticated trading tools such as order books, charts, and market data. Those who make use of BingX love to trade on the platform because it does not require users to go through a KYC process.

Trading fees on BingX are 0.02% and 0.05% maker and taker for futures trading, and 0.1% maker and taker for spot trading.

A major downside with BingX exchange is that it does not offer payments in fiat currency. Therefore, deposits and withdrawals are all done in cryptocurrency.

6. BYDFi

BYDFi is a cryptocurrency exchange that was established in 2019 and is based in Singapore. It currently stands among the top-rated exchanges on the market and is easily accessible to users who wish to start trading without KYC verification.

BYDFi has a daily trading volume of $137 million on its spot market and $6 billion for futures. Users also have access to 240 cryptocurrencies with a unique trading platform and fast execution.

BYDFi fees are 0.1% maker/taker for spot trading, and 0.02% and 0.06% for futures trading.

Additional features of BYDFi include a copy trading platform, a global community, multiple withdrawal methods, and welcome rewards for new users.

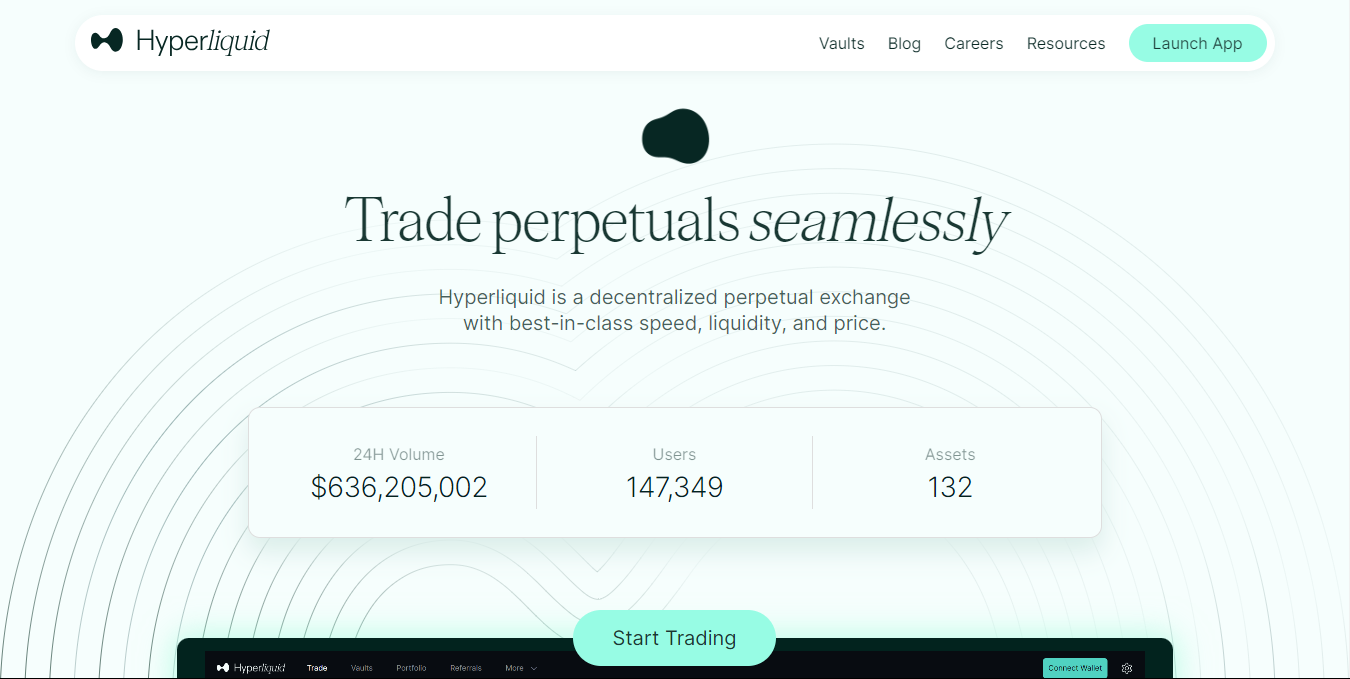

7. Hyperliquid

Hyperliquid is a premier decentralized exchange where users can trade perpetual futures contracts. The exchange is decentralized, meaning that it is not owned by any centralized authority. It is powered on a Level 1 blockchain and utilizes Tendermint for quick consensus. Users can therefore trade and make withdrawals on the platform without KYC verification.

Hyperliquid has a 24-hour trading volume of $636 million, with 147,000+ users worldwide. It offers 132 assets for traders to select from, including much more common ones such as BTC, ETH, SOL, and many others.

When it comes to fast-paced, Hyperliquid offers a seamless trading platform and trade executions in less than a second. It also offers advanced trading tools for users, including order types such as TWAP, Scale, Stop loss, and Take profit, all gotten from the TradingView terminal.

Hyperliquid offers users low fees on trades, with a maker fee of 0.01% and a taker fee of 0.03%. It also provides leverage of up to 50x for all trades.

Additionally, Hyperliquid possesses extra features such as a custom Level 1 vault, where users can automatically copy trades, and share profits/losses. It also provides a blog for users to gain new information, a docs page for all relevant information, and a guide page for new users.

8. Margex

Margex provides a state-of-the-art trading infrastructure for digital assets. Established in 2019, the exchange is widely recognized as one of the top platforms for trading cryptocurrency derivatives.

It has become remarkably well-known since its launch and is most notable for its no-KYC benefits. This means that you can trade on Margex without having to verify KYC.

Margex provides one of the best secure non-KYC exchange trading platforms, with tools that aid users of any level to trade. Users also have access to leverage up to 100x when trading.

For deposits and withdrawals, Margex does not provide an ample amount of payment options for users to select from. Payments can only be made via direct crypto deposits, or with a credit/debit card purchase.

Margex fees are taken in two forms. There is a standard trading fee of 0.01% maker and 0.06% taker. There is also a funding fee taken every time a trade exceeds an 8-hour funding period.

Additionally, Margex offers users a 24/hr live chat and email access for all inquiries regarding their platform. A help center is also available for users to reach for all the necessary information they require concerning the platform.

9. dYdX

dYdX is another exchange that functions without users having to verify KYC. It is an advanced decentralized trading platform that runs on a DeFi chain, is controlled by a governance protocol, and offers fast trading to users worldwide.

dYdX is an open-source decentralized protocol that offers users access to 66 markets, a fully on-chain trading platform, as well as sophisticated features for a quality experience. The exchange was founded in 2017 and has grown to be among the leading decentralized exchanges on the market. Like other decentralized exchanges, dYdX does not require KYC from its users.

Among other things, dYdX provides a seamless trading platform for users, but users may need to be vast in the decentralized world before considering this exchange, so it may not be suitable for beginner traders.

It also offers low fees, a self-custody wallet, instant earning rewards, a fast onboarding process using Metamask wallet, and a help center for additional information.

10. CoinEX

CoinEX is a cryptocurrency exchange based in Hong Kong that supports spot and futures trading. Users are free to trade and make withdrawals on the platform without KYC.

CoinEX offers a wide range of assets, with 1000+ cryptocurrencies and 1400+ markets. The exchange claims to have 5 million users worldwide, and a daily trading volume of $534 million.

CoinEX fees are higher than the industry standard. The exchange requires a 0.2% fee for spot trading and a futures fee of 0.03% and 0.05% for maker and taker.

On CoinEX, users can only have $10,000 in cryptocurrency in a single day if they don’t have KYC. To raise this figure, the user would need to confirm their account. To safeguard user assets and data, the platform employs several security mechanisms, including multi-signature, anti-DDoS, and cold storage. If the market is manipulated, all losses can be covered by the reserve fund for futures.

11. Jupiter DEX

Jupiter DEX is the go-to place for fast cryptocurrency trading with the best rates. The exchange was launched in 2021 and is a decentralized exchange that functions on the Solana wallet.

Jupiter is a user-friendly exchange that offers an easy-to-navigate platform for both seasoned traders and amateurs. Among other things, the platform prioritizes security and cost-effective transactions for all users.

The exchange fully operates on the Solana chain without KYC but allows users to trade across multiple DEX with on-chain liquidity. It also gives access to real-time transaction tracking upon execution, a fast on-ramping process from your wallet to the exchange, and control of trades through limit orders to ensure that users enjoy trading at the best price.

Jupiter offers additional features, such as a station for new users to learn about the exchange, a research page for sourcing new projects on the Solana blockchain, and a guides page. Users who want to get involved with the Solana chain directly can also access it using the exchange.

12. Changelly

Changelly is a non-custodial exchange where users can trade or swap cryptocurrencies even without having to sign up, making it very convenient for users to enjoy trading.

Changelly partners with over 20 crypto trading platforms to provide the most competitive rates for user transactions, bringing about low fees on trades.

On Changelly, users can do direct crypto-to-fiat and fiat-to-crypto transactions through various payment methods, and receive payments directly into their bank accounts through credit/debit cards, and bank transfers.

With costs on cryptocurrency exchanges as low as 0.25%, Changelly provides instant execution on trades. Users have access to 700+ cryptocurrencies and up to 25,000 trading pairs. The exchange remains a great option for users who wish to purchase tokens, coins, and stablecoins instantaneously with a credit card, bank account, or Apple Pay, exchange thousands of cryptocurrencies at a fast pace, and enjoy the security of assets while trading.

13. ApeX Pro

Among the list of no-KYC decentralized exchanges, is ApeX, a non-custodial exchange launched in November 2022. The exchange is relatively new but is already gaining ground among DEX platforms, currently at $51 billion as the total trading volume, and a growing community of crypto enthusiasts.

ApeX is a DEX owned by Bybit, one of the top centralized exchanges, as a way to solidify its support of the DEX ecosystem, and it comes with comparatively low fees. The DEX has also been integrated by other exchanges, including MEXC, and CAMELOT.

Futures traders on ApeX enjoy low fees of 0.02%/0.05% maker/taker for trades and comes with a staking pool, where users can earn while trading on the platform. It also provides a fast-paced trading platform, with up to 30x leverage.

ApeX is a decentralized exchange, meaning that users don’t have to worry about KYC verification before accessing trades or making payments.

14. PrimeXBT

PrimeXBT is a Bitcoin-based crypto exchange company that was established in 2018. Since its inception, the exchange has continually experienced exponential growth, serving clients in over 150 countries. While preserving security and liquidity, the exchange provides clients access to a vast array of trading tools and first-rate liquidity, facilitating a safe and effective atmosphere for all traders.

Apart from its quality user interface, trading terminal, and asset range, PrimeXBT is also popular for its no KYC trade access, allowing its users to carry out trades and make withdrawals on an anonymous user basis.

PrimeXBT has a day trading volume of $283 million, with 110+ assets for 1 million+ users worldwide to select from for trading. More than that, users can also trade traditional finance, including forex pairs, commodities, and stocks with no trading limits for unverified users.

For fees, PrimeXBT charges a fee of 0.01% for the maker and 0.02% for taker on all cryptocurrency trades. There is strong attention to Bitcoin on the exchange, and it even has a Bitcoin leverage tool.

There are many tools for users to select from, including market research tools, price charts, Bitcoin leverage tools, Long/short trading tools, and copy trading tools. Users also have access to an academy where they can learn to perfect their skills and trade better on the platform.

Unfortunately, the exchange does not support fiat currencies and users can only make withdrawals or deposits in cryptocurrencies. The exchange also does not support spot trading on its platform.

What is KYC?

KYC is an acronym for Know Your Customers. It is a process of verifying customer identity to prevent exchanges from hacks, criminal behaviors, or money laundering. KYC is a way for exchanges to gather information about each of their clients, including name, address, date of birth, and government-approved IDs.

The term KYC, or Know Your Customer, refers to a standard procedure implemented by financial services that handle fiat payments from their customers. During, or after registration, clients are typically required to provide certain minimum information. This includes their full name, residential address, and date of birth.

Benefits of using a no-KYC crypto exchange

One of the main advantages of using a no-KYC exchange is privacy. These exchanges do not require users to disclose personal information before accessing its features, which protects user identity.

Accessibility is another advantage of no-KYC exchanges. These platforms can be accessed by anyone, anywhere, without the need for identity verification. Furthermore, no KYC exchanges allow users to buy and sell cryptocurrencies anonymously. For most of the DEX platforms, users may not be required to open an account or upload verification documents. They simply access the platform by connecting a wallet.

Are no-KYC exchanges safe and secure?

No-KYC exchanges can be safe depending on the security measures employed. Generally, for DEX, users need to be careful and ensure they know how these exchanges work to avoid making costly mistakes.

When choosing a no-KYC exchange, it’s important to consider its security history and protocols. While they offer privacy and anonymity, they also have increased risks. It’s important to research thoroughly before choosing a no-KYC exchange for trading.

Do I still have to pay taxes on no KYC exchanges?

Yes, users are still required to pay taxes on transactions made through no-KYC exchanges. The absence of KYC procedures does not exempt users from their tax obligations. Regardless of whether an exchange requires KYC or not, all gains from cryptocurrency trading are typically subject to tax according to the laws of your jurisdiction.

Summary

No-KYC exchanges are gaining more popularity and trust among crypto traders. They have become a means for traders to enter and exit markets easily, and keep their privacy to themselves.

No-KYC crypto exchanges offer several options for those who value privacy and speed in their crypto transactions. These platforms, while not without their risks, provide a crucial service in the crypto ecosystem. They cater to millions of users worldwide, from privacy advocates to frequent traders, and individuals in restricted countries, to non-institutional investors.

However, users need to conduct thorough research and exercise caution when using any exchange. This article has presented some of the best exchanges that you can access without having to verify your identity. From the list given, users of all kinds can now begin trading on these exchanges without the fear of verification hurdles.

FAQS

Are No-KYC crypto exchanges safe?

While some of the exchanges that offer trading without KYC are safe, others can be considered highly risky. Traders are therefore advised to conduct proper research before selecting an exchange.

Can I buy crypto on non-KYC exchanges?

Yes, you can purchase crypto on many non-KYC exchanges, such as Blofin, BingX, and Bitunix.

Is Bybit no KYC?

Bybit requires users to complete KYC verification before they can begin making deposits and trading on the platform.

Are non-KYC exchanges available in the US?

Most non-KYC exchanges are not available to US residents as their methods do not comply with US laws. As such, users who choose non-KYC exchanges have to do so using VPNs to change their location.