APY Calculator with Compounding

Growth Projection

Breakdown

| Year | Interest Earned | Total Interest | Balance |

|---|

What is a Compound Interest Calculator?

A Compound Interest Calculator is a powerful tool that calculates the growth of an investment or savings account over time, considering the compounding effect. Compounding means that the interest earned on an investment is reinvested, generating additional interest over time. This calculator is essential for those looking to estimate how their money can grow when interest is compounded periodically.

How Does Compound Interest Work?

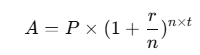

Compound interest is calculated by adding earned interest back to the initial principal amount, so future interest calculations include the accumulated interest. This cycle leads to exponential growth, especially with frequent compounding periods and longer investment durations. The formula for compound interest is:

Explainer:

- A is the final amount (principal + interest),

- P is the principal (initial amount),

- r is the annual interest rate (decimal form),

- n is the number of times interest is compounded per year,

- t is the time in years.

The calculator simplifies this process, allowing users to quickly see how much their investment will grow based on their inputs.

How to Use the Compound Interest Calculator

- Enter Initial Investment Amount – Start by entering the initial amount (principal) you plan to invest or save.

- Specify the Interest Rate – Input the annual interest rate (APR). A higher interest rate results in more significant growth.

- Choose the Investment Period – Enter the total duration of the investment in months.

- Select Compounding Frequency – Select how often the interest is compounded (daily, weekly, monthly, quarterly, or annually). More frequent compounding periods lead to faster growth.

Once these inputs are filled in, click “Calculate” to see the results. The calculator will display the final amount, total interest earned, and a breakdown of monthly or yearly balance growth, depending on the compounding period.

Why Compound Interest is Powerful

Compound interest accelerates the growth of an investment over time, making it a key component of wealth-building strategies. The longer the investment duration, the more time compound interest has to work its magic, especially with higher interest rates and frequent compounding.

Example: A $1,000 investment at a 5% annual interest rate, compounded monthly, will grow to approximately $1,647 after 10 years. The longer the investment remains untouched, the larger the difference compound interest can make.

Applications of the Compound Interest Calculator

The Compound Interest Calculator has various applications in both traditional finance and modern crypto investments:

- Savings Accounts: Most savings accounts offer compound interest, which helps maximize returns over time.

- Fixed Deposits: Fixed deposits compound interest at fixed intervals, making this calculator helpful for estimating returns on such investments.

- Crypto Staking: Many cryptocurrencies offer staking with compounding rewards, which makes this calculator valuable for crypto investors.

- Investment Planning: Investors use compound interest to plan long-term growth in portfolios, retirement accounts, or educational funds.

Benefits of Using a Compound Interest Calculator

The calculator provides insights that can be instrumental in making informed financial decisions. Key benefits include:

- Forecasting Investment Growth: See how your initial investment could grow over time with different interest rates and compounding frequencies.

- Comparing Compounding Scenarios: Experiment with different compounding intervals (e.g., monthly vs. yearly) to find the best strategy for maximizing returns.

- Encouraging Long-Term Savings: By visualizing how interest accumulates over time, users may be encouraged to save more and invest for extended periods.

Compound Interest Calculator Example

Suppose you invest $5,000 with an annual interest rate of 4%, compounded quarterly, for a period of 5 years. Using the calculator, you’ll find:

- Final Amount: $6,083.26

- Total Interest Earned: $1,083.26

This example demonstrates how compound interest can significantly grow an investment, even with modest interest rates.

Start Using the Compound Interest Calculator

Ready to calculate your investment’s future value? Enter your details into the Compound Interest Calculator to explore how compounding can help grow your money. Experiment with different scenarios to find the best combination of initial investment, interest rate, and compounding frequency for your financial goals.