- •Beam in 2025 a gaming focused Layer 2 on Avalanche with EVM support expanding through staking memecoins and new DEX launches.

- •The official Beam Bridge using LayerZero is the secure route while Allbridge and aggregators provide options for non EVM chains.

- •Use only the official link keep BEAM for gas from Binance and check fees and transaction hashes to avoid issues.

Beam has steadily positioned itself as one of the leading gaming-focused Layer-2 solutions in 2026. Built on Avalanche subnets with EVM compatibility, it gives developers and players low-cost, secure access to in-game assets, NFT marketplaces, and governance tools. The reason so many users are seeking to bridge to Beam is simple: it has become the entry point for on-chain gaming economies and DAO participation.

Recent months have seen Beam’s ecosystem expand with more staking integrations, a rising memecoin trend, and new decentralized exchanges launching within its hub. This activity signals Beam’s attempt to carve a durable spot in the competitive L2 market, making bridging into the network more relevant than ever.

Prerequisites

Before you begin, make sure you have:

- A Web3 wallet such as MetaMask, already set up and funded, configured to connect with the Beam network.

- Enough BEAM tokens to pay gas once assets arrive on the network. You can acquire Beam for gas fees on Binance.

Step-by-Step Guide: Bridge to Beam via Beam Bridge

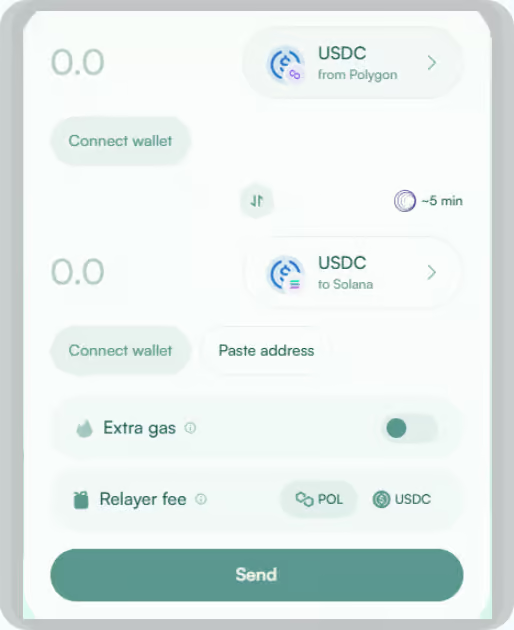

The Beam Bridge is the most direct and secure way to bridge to Beam. It uses the LayerZero protocol to move assets and NFTs across multiple chains. Here’s how to do it safely:

Alternative Platforms

While the Beam Bridge remains the official gateway, there are workarounds if you start from non-EVM chains.

-

Allbridge

If you hold assets on Solana or Polkadot, Allbridge lets you first transfer tokens to an EVM chain (Ethereum, Arbitrum, BNB Chain, Avalanche). From there, you can use the Beam Bridge to finish the route into Beam. It’s a two-step process but reliable for non-EVM assets.

- Bridge Aggregators

Some aggregators route through multiple chains to reach Beam. They may come with higher fees than Beam Bridge directly, but they’re useful when comparing speed or available token pairs.

Security Considerations / Troubleshooting

- Use only the official Beam Bridge link to avoid phishing attempts. Fake bridging sites are common targets.

- Check RPC details manually when adding Beam to MetaMask; never copy them from unverified sources.

- Expect variable fees. Gas surges on Ethereum can raise bridging costs, so bridging during low-activity hours often helps.

- If a transaction stalls, confirm the transaction hash on both the origin and destination block explorers before retrying.

Final Thoughts

Bridging is the first step into Beam’s gaming and DAO-driven ecosystem. By moving assets through the Beam Bridge, users position themselves to access Beam’s NFT marketplaces, participate in governance, and interact with dApps that continue to grow in 2026. The process may feel technical, but with a little care on fees and wallet setup, it opens up the network where gaming and blockchain experiments are being tested at scale.

FAQs

1. Can I bridge NFTs to Beam?

Yes. The Beam Bridge supports NFT transfers as long as the standard (ERC-721 or ERC-1155) is compatible with LayerZero.

2. What happens if I forget to bring BEAM tokens for gas?

If you skip adding “Gas on Destination” during bridging, your assets will arrive but you won’t be able to transact until you acquire BEAM from an exchange like Binance.

3. Is bridging from Solana directly possible?

Not yet. You’ll need to bridge Solana assets first to an EVM chain (via Allbridge) and then complete the transfer through the Beam Bridge.

4. How long does it take to bridge assets to Beam?

Bridge times depend on the origin chain congestion and confirmation speed most transfers complete in a few minutes but heavy traffic on Ethereum or Solana can extend this.

5. Are there limits on how much I can bridge at once?

The Beam Bridge itself does not impose strict limits but gas costs and liquidity on the origin chain may affect larger transactions always verify available liquidity before sending big amounts.