- •WLFI is riding launch hype with heavy volumes and nonstop social chatter making it a headline token right now

- •Bybit currently has the WLFI/USDT pair with strong liquidity simple onboarding and live promos making it the most practical place to buy right now

- •Beware fake tokens using the same WLFI ticker always verify the official Ethereum contract 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6 before you buy

WLFI has everyone talking for a reason: it moved from a governance-only presale to live trading on top-tier exchanges, drew billions in early volume, and sits at the center of a politics-meets-crypto narrative that refuses to cool down. The token is now listed on major venues like Binance and Bybit, which supercharged awareness and liquidity from day one. Add in a flood of social chatter and proposals around buyback-and-burn mechanics, and you’ve got a launch that’s both hyped and controversial. If you’re exploring the project, this guide walks you through where to buy WLFI and the exact steps to help you out in your first purchase.

Where to Buy WLFI

We reviewed the platforms where WLFI is available and found Bybit to be the most suitable choice, mainly because of its short-term 100% APY promotional offer.

How to Buy WLFI on Bybit

Bybit lists WLFI with an active WLFI/USDT spot market. Follow these steps to place a simple order without overthinking settings.

Alternatives to Buying on Bybit

If Bybit is unavailable in your region or you prefer a different interface, WLFI also trades on Binance and Ourbit.

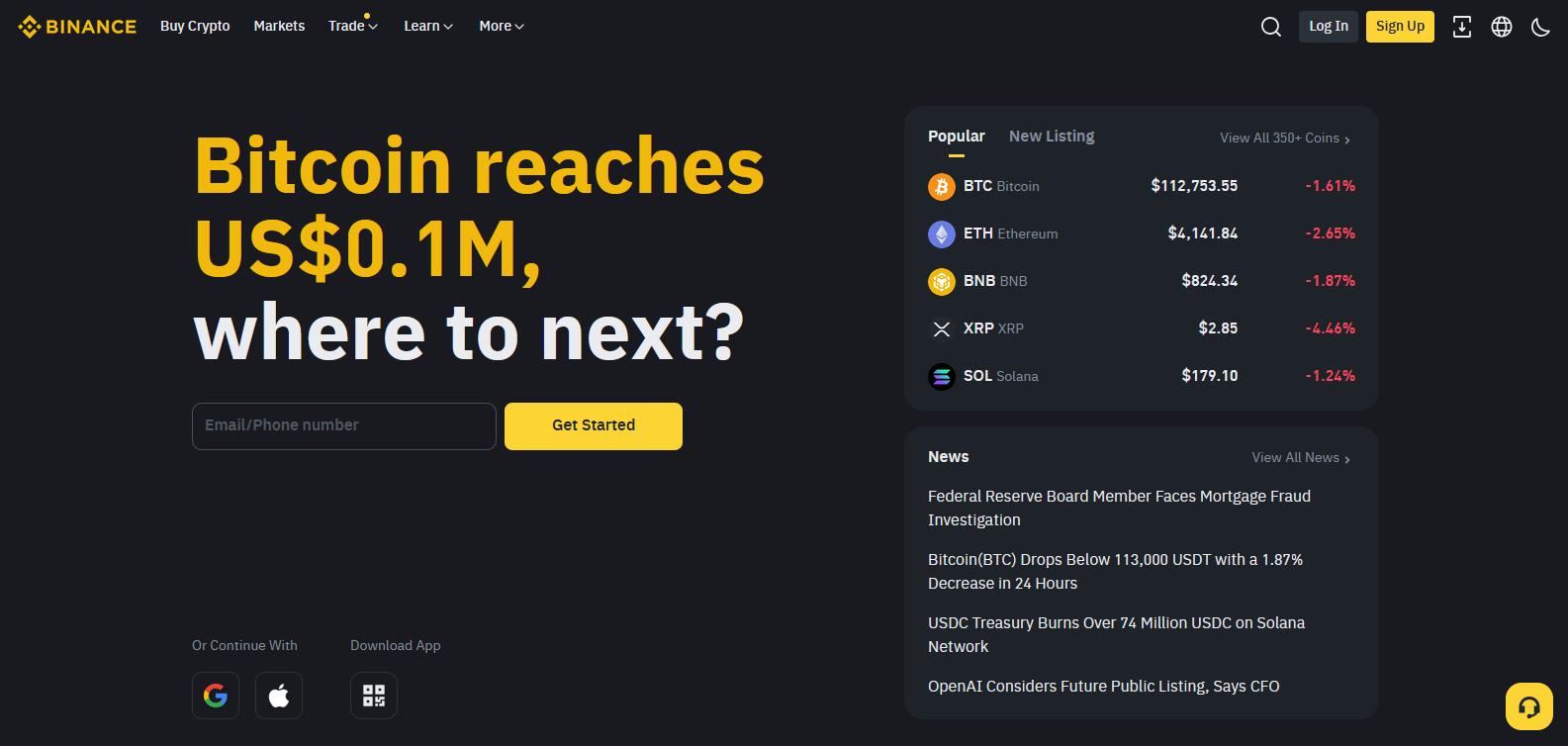

Binance

Binance is a high-liquidity venue with multiple WLFI spot pairs. Onboarding is straightforward, with funding options like card payments, P2P, and third-party providers. Open the WLFI asset page to confirm the contract and pair before you place an order. Suitable for buyers who want deep books and fast execution.

Ourbit

A lighter, clean interface and a good choice to buy WLFI on spot markets. Ourbit is great for users who want a simple layout and quick order placement. Funding rails vary by region, so check the deposit screen inside the app before moving funds. Verify the WLFI pair and fees to keep costs predictable.

What is WLFI?

WLFI is the governance token of World Liberty Financial, issued as an ERC-20 asset on Ethereum with a 100 billion token supply. The tradability switch flipped in September 2025 after a community vote, moving WLFI from non-transferable governance to open market listing on major exchanges.

Importantly, an entity linked to the Trump family, DT Marks DEFI LLC, received 22.5 billion WLFI and holds a contractual right to 75% of net protocol revenues (after specified expenses and reserves), a structure that drives both attention and criticism. WLFI’s stated purpose is governance, not revenue rights for token holders, and buyers should rely on verified contract data to avoid clones.

Bottom Line

WLFI is liquid and under increased scrutiny, which explains the current attention. If you choose to purchase, maintain strict execution discipline: use reputable exchanges, select the WLFI/USDT market, and verify the official contract address before transferring assets. Promotions and yields vary by product and time, so confirm terms within the platform rather than relying on headlines. Start with a small allocation, validate funding and withdrawals end to end, and scale only after a successful test.

FAQs

1. What’s the official WLFI contract address?

Ethereum ERC-20: 0xdA5e1988097297dCdc1f90D4dFE7909e847CBeF6 (match this on any exchange page before depositing).

2. Does Bybit offer fixed “100% yield” on WLFI?

No fixed rate is guaranteed. Bybit runs promos and Earn products, and APY varies by product and time. Always check in-app.

3. Is WLFI a revenue-sharing token?

No. WLFI is for governance. A separate agreement grants DT Marks DEFI LLC 22.5B WLFI and 75% of net protocol revenues.