- •

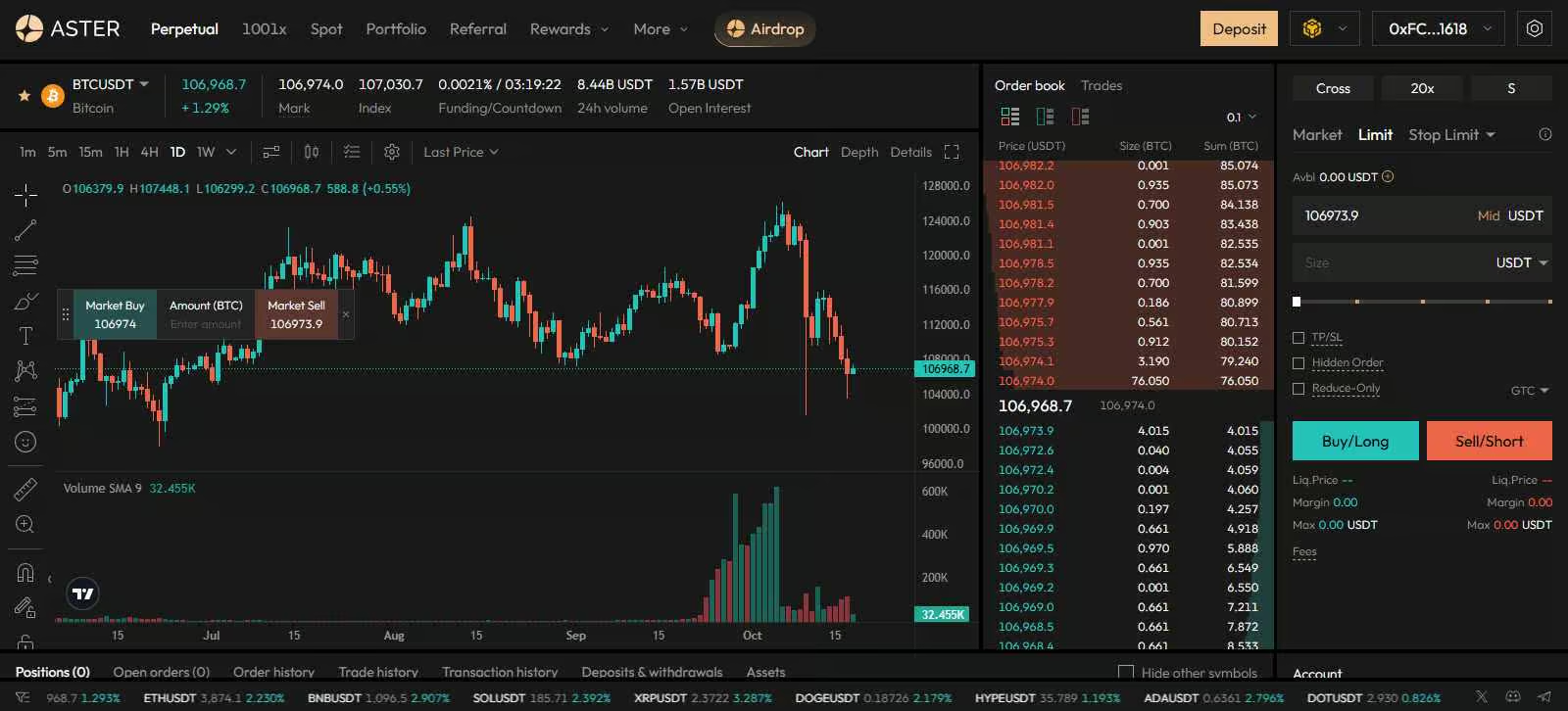

Aster ($ASTER) is a rapidly growing DEX token on BNB Chain, supporting spot, perpetual, and 1001x leverage trading on BTC and ETH. - •

The exchange’s daily trading volume has surpassed $1.45B, while $ASTER’s 24-hour DEX volume is nearly double that of $HYPE. - •

You can buy ASTER on Bitunix, a no-KYC exchange with 0.10% fees and deep liquidity for both new and active traders.

Aster ($ASTER) has quickly gained attention as one of the fastest-growing tokens in the DEX trading space. Built on BNB Chain, Aster powers a multi-chain exchange that offers spot, perpetual, and even 1001x leverage trading on BTC and ETH. Daily trading volume has already crossed $1.45B on the exchange, and $ASTER’s 24-hour DEX volume has nearly doubled that of $HYPE, its closest competitor. For crypto investors and traders looking to buy ASTER and gain direct exposure to the Aster DEX ecosystem, Bitunix provides a secure and liquid environment to begin trading.

Where to Buy ASTER Tokens

There are many exchanges where you can buy Aster, but it’s important to look at different aspects of each platform; from trading fees and liquidity to security and ease of use. In this guide, we’ll be using Bitunix.

Aster ($ASTER) is available on multiple global exchanges, but Bitunix offers one of the most convenient and liquid options for traders worldwide. With 0.10% maker / 0.10% taker spot fees, deep liquidity, and a no-KYC setup, Bitunix provides a smooth experience for both first-time buyers and active traders. Its simple interface, strong security track record, and wide token coverage make it an ideal starting point for anyone looking to add $ASTER to their portfolio.

How to Buy ASTER on Bitunix

The steps to buy Aster on Bitunix are relatively simple, here is how:

Alternatives to Buy ASTER Tokens

If Bitunix is unavailable in your region or you prefer a different interface, Aster ($ASTER) is also listed on BloFin and Bitget.

BloFin

A Cayman Islands–based exchange launched in 2019, BloFin supports over 564+ cryptocurrencies and offers leverage up to 150x with no KYC required. Its $9.7 billion daily futures volume and easy onboarding make it popular among privacy-focused traders.

Bitget

Founded in 2018 in Singapore, Bitget serves over 8M+ users with 870+ supported coins and up to 125x leverage. Its deep liquidity, copy trading tools, and reliable security make it a strong global alternative for Aster trading.

What is Aster DEX?

Aster DEX is a multi-chain, non-custodial perpetual exchange built on Aster Chain, registered in Mahé, Seychelles, and backed by YZi Labs, an affiliate of Binance Labs. Formed after the merger of Astherus and APX Finance in March 2025, the platform offers spot, perpetual, and 1001x leverage trading across crypto, forex, and stock markets.

Users can access 93+ perpetual contracts with up to 100x leverage and low fees starting from 0.005% maker / 0.04% taker. With over 2 million users, daily trading volumes exceeding $10 billion, and a growing TVL, Aster DEX is quickly becoming a leading player in DeFi derivatives. Its native token, $ASTER, powers governance, rewards, and ecosystem growth.

Bottom Line

Aster continues to capture attention as one of the fastest-growing DEX tokens, backed by strong trading activity and expanding liquidity on BNB Chain. Its presence on exchanges like Bitunix, BloFin, and Bitget makes it accessible to traders across regions. As the Aster ecosystem evolves, its market performance will largely reflect how well the platform sustains this early momentum.

FAQs

1. Is KYC required to buy Aster on Bitunix?

No, Bitunix allows users to trade and withdraw up to $50,000 daily without completing KYC verification, making it convenient for privacy-focused traders.

2. What is the main use of the Aster token?

The $ASTER token is primarily used for trading fee discounts, governance participation, and future staking within the Aster DEX ecosystem. As the platform expands, additional utilities may be introduced.

3. Is Aster a good long-term project?

Aster has shown early strength with high trading volumes and backing from the BNB Chain ecosystem. Its long-term potential depends on how effectively it sustains growth, attracts liquidity, and delivers new features over time.