Not every exchange offers extreme leverage alongside a large altcoin selection. WEEX, operating since 2017, has grown to over 5 million users and built a strong presence in futures trading. In this WEEX review, we look at its features, fees, leverage, security, and overall trading experience.

WEEX Overview

In this WEEX Review, we take a closer look at the cryptocurrency exchange launched in 2017, founded and led by CEO Ricardo Suarez. Based in Singapore, WEEX serves over 100 countries and has grown to support more than 5 million users. Its trading activity includes a 24-hour spot volume of $1.70 billion and a futures volume of $17.89 billion. The platform does not mandate KYC, making it a go-to for those who prioritize privacy.

WEEX’s native token, WXT, adds value within its ecosystem, though specific perks remain unclear. The exchange restricts access in countries under OFAC and UN sanctions, ensuring compliance. A $20,000 trading bonus welcomes new sign-ups, giving traders a head start. With support for 14 languages like English and Japanese, WEEX is built for global reach.

The primary focus of WEEX is spot and futures trading for a wide variety of over 509+ coins. Other notable features include copy trading, airdrops, and regular events and competitions where users can earn real rewards.

Where WEEX Stands Out

WEEX shines with its sky-high leverage and extensive cryptocurrency lineup, a magnet for futures traders and altcoin fans. Offering up to 400x leverage on futures, it’s a standout for those chasing big returns. The platform hosts over 509+ cryptocurrencies for spot trading and 720+ futures contracts, giving traders a deep pool to dive into. No KYC requirement means you can withdraw up to $50,000 daily without sharing personal details.

Free internal transfers between WEEX users keep costs down, a handy feature for frequent traders. The interface is straightforward, with support in languages like Spanish and Korean, welcoming users worldwide. On the downside, limited company transparency and reliance on crypto-only transactions might give some traders pause. WEEX’s blend of power and privacy makes it a top pick for bold altcoin and futures strategies.

WEEX Products, Features, & Services

WEEX delivers a crypto-focused platform with spot and futures trading at its core. It supports over 509+ cryptocurrencies and 720+ futures contracts, catering to traders of all stripes. Copy trading lets users mirror top performers, while P2P trading enables direct crypto swaps. Demo trading offers a risk-free way to test strategies, a plus for newcomers.

The platform’s mobile and web apps are user-friendly, available in 14 languages, from English to Portuguese. WEEX’s affiliate program pays a 40% commission, rewarding those who bring in new users. Support is available 24/7 via live chat and email, ensuring help is at hand. Without fiat currency support, all transactions are crypto-based, which streamlines things for digital asset enthusiasts.

Free internal transfers between WEEX accounts add a cost-saving edge. The platform’s high leverage and broad asset range target active traders, though futures dominate over spot. WEEX’s language support and no-KYC policy make it accessible, but fiat limitations may not suit everyone. It’s a solid choice for crypto purists seeking flexibility.

WEEX Pros & Cons

| ✅ WEEX Pros | ❌ WEEX Cons |

|---|---|

| 509+ cryptocurrencies supported | No FIAT support |

| 400x futures leverage | Limited company details |

| No KYC required | Moderate spot volume |

| 0% fee internal transfers | Potential security risks |

| 14 language options | Sanctioned country restrictions |

Signup & KYC

Getting started on WEEX is quick, with no KYC needed to begin trading. You can sign up using an email and withdraw up to $50,000 daily without verification. For higher limits, Level 1 KYC requires personal details, a government-issued ID, and a selfie or video. New users are eligible for a trading bonus of up to $20,000, subject to platform terms and activity requirements.

Level 1 KYC boosts withdrawals to $100,000 daily. Higher KYC levels exist, but their requirements and limits are unclear. The optional KYC setup makes WEEX appealing for those valuing privacy, especially in supported regions.

Withdrawal Limits

With a generous withdrawal limit of $50,000 for unverified users, WEEX is a popular contender for no-KYC traders. If you need higher withdrawal limits, you can unlock them by doing the KYC verification.

| KYC Level | Daily Withdrawal Limit |

|---|---|

| No KYC | $50,000 |

| Level 1 KYC | $100,000 |

WEEX Supported Assets

WEEX offers over 509+ cryptocurrencies for spot trading, from Bitcoin to niche altcoins, perfect for altcoin traders. Futures trading includes 720+ contracts with up to 400x leverage, a standout for high-stakes strategies.

The WXT token supports ecosystem benefits, though details are sparse. No stocks, commodities, forex, or options trading are available, keeping the focus on crypto.

Spot trading lacks margin options, limiting leverage, but the sheer number of coins may make up for it. The platform’s broad crypto range and high futures leverage cater to traders chasing variety and risk. WEEX’s asset lineup is a strong draw for those deep in the crypto space.

WEEX Trading Options

WEEX provides spot and futures trading, with a 24-hour spot volume of $1.70 billion and a futures volume of $17.89 billion. It supports over 509+ cryptocurrencies for spot trading and 720+ futures contracts, offering plenty of choices. Futures trading shines with 400x leverage, attracting those comfortable with high risk. Copy trading lets users follow seasoned traders, ideal for beginners.

Demo trading at WEEX allows risk-free practice, a great way to test the platform.

WEEX’s futures market is the star, with strong liquidity and extensive contract options. Spot trading is solid but less prominent due to moderate volume. The platform’s high leverage and copy trading make it approachable yet powerful. Traders focused on altcoins will find plenty to work with, though the crypto-only focus narrows its scope. WEEX’s demo mode rounds out a platform built for active crypto enthusiasts looking to improve their trading skills.

No stocks, commodities, forex, options, or bot trading are supported, so it’s all about crypto. The interface is clean, with real-time charts and order books for smooth navigation.

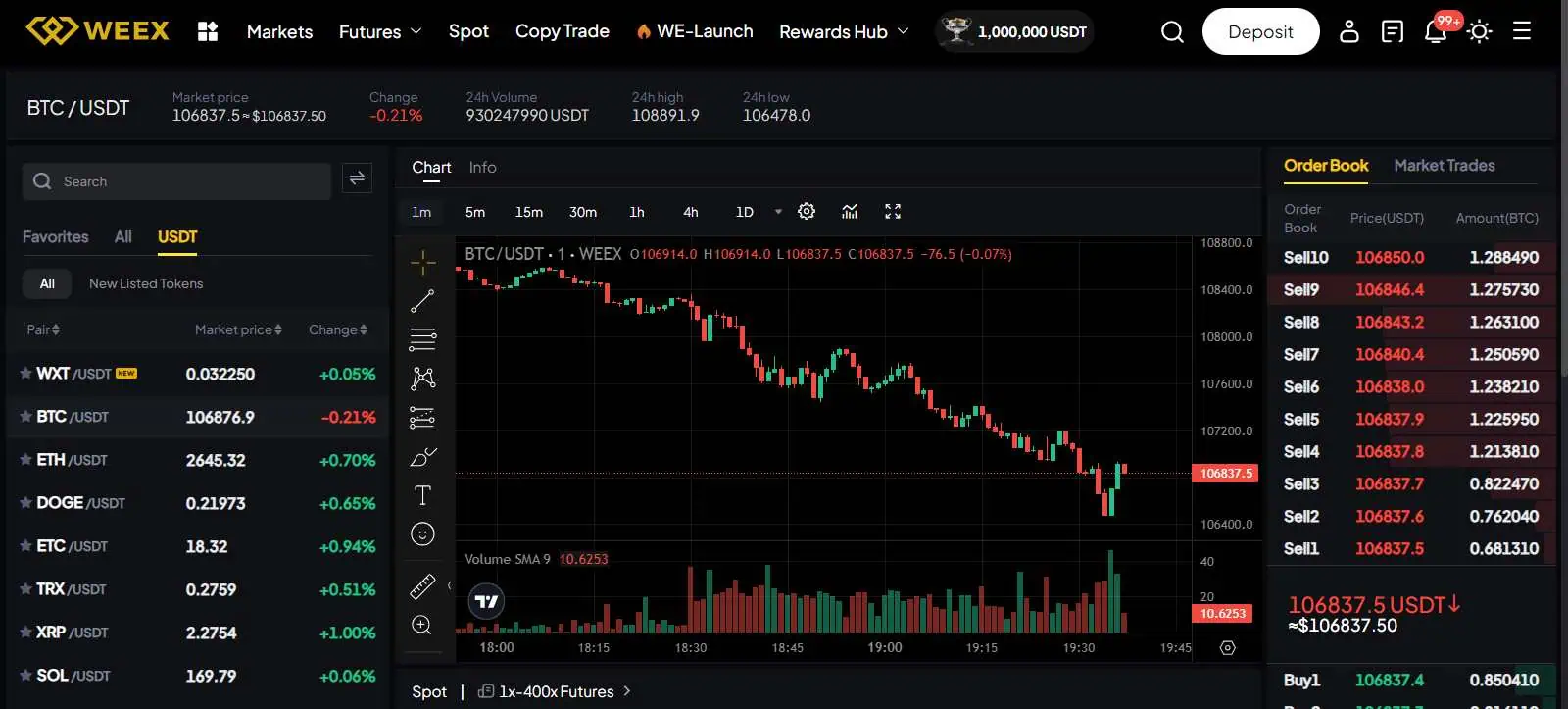

Spot Trading

WEEX’s spot trading covers over 509+ cryptocurrencies, including major coins and altcoins. The 24-hour spot volume of $1.70 billion offers decent liquidity for most trades. Without margin trading, leverage isn’t an option, which may limit some strategies. The interface is intuitive, with tools to track market movements.

Supported order types include:

- Market orders

- Limit orders

- Immediate or Cancel (IOC)

- Fill or Kill (FOK)

- Good Till Cancelled (GTC)

- Post Only

These options work well for altcoin traders and those starting out.

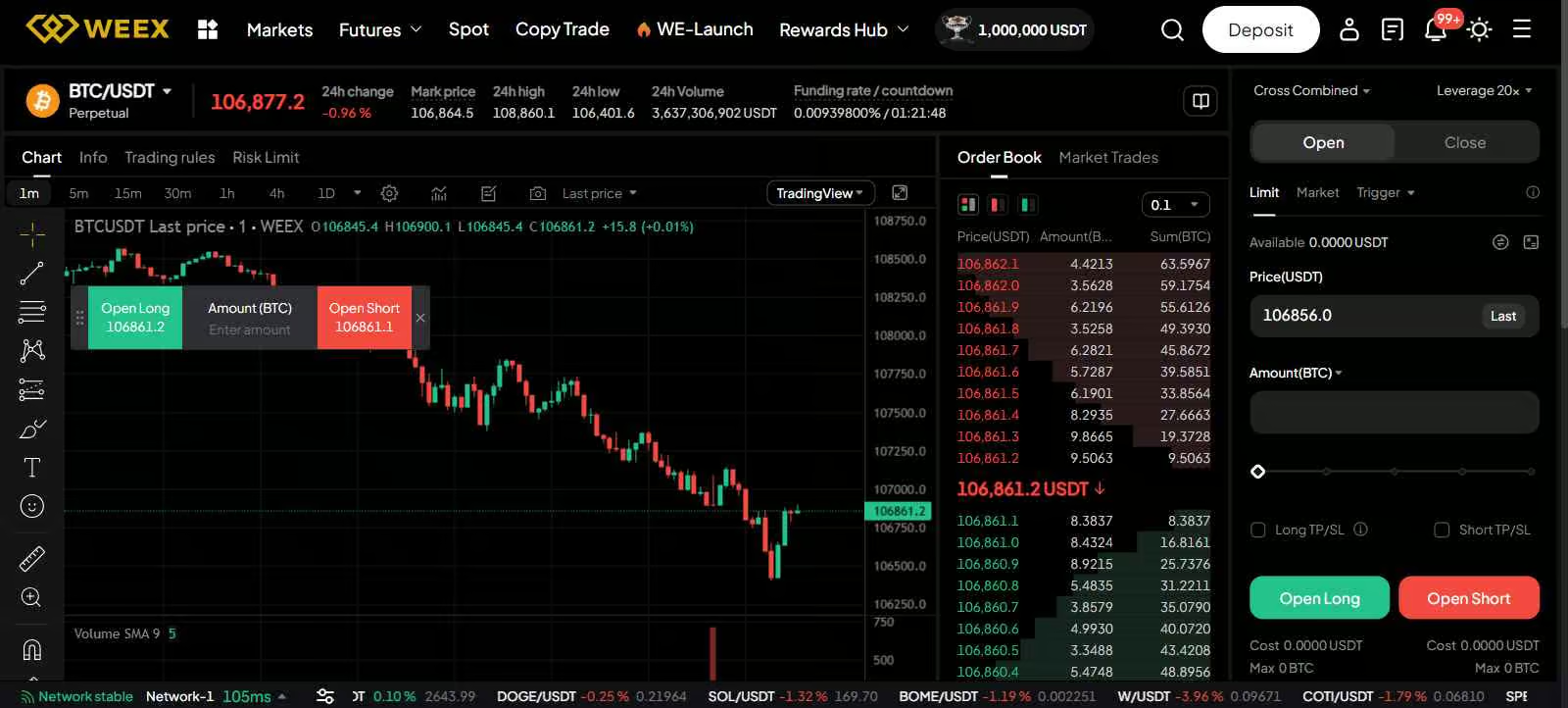

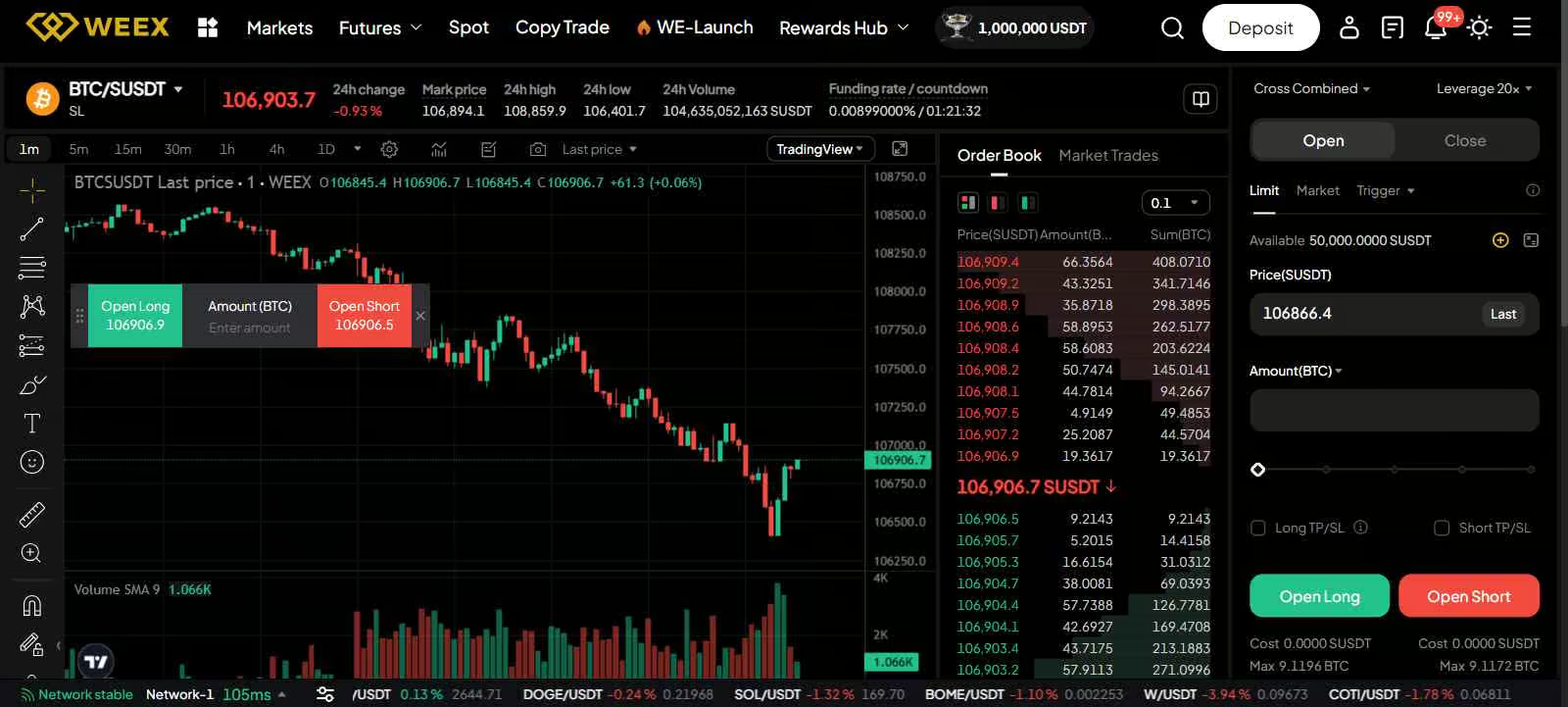

Futures Trading

WEEX’s futures trading supports 720 contracts, with a $17.89 billion 24-hour volume, showing strong liquidity. Leverage up to 400x draws traders chasing big gains, though it’s not for the faint-hearted. Perpetual contracts add strategic depth and offer traders to use their capital in the most efficient way.

With directly integrated TradingView charts, traders at WEEX can conduct analysis directly on the WEEX website. Additionally, WEEX displays the market trade history as well as the order book.

Supported order types for futures include:

- Market orders

- Limit orders

- Trigger orders

- Post Only

- Take Profit/Stop Loss (TP/SL)

The wide contract range, high leverage, and advanced order types makes WEEX a top pick for futures trading.

Copy Trading

WEEX’s copy trading feature lets users mirror the moves of experienced traders. It’s simple to set up, with clear performance stats to pick the right leaders. This is a solid tool for those new to spot or futures trading, saving time while learning.

Copy trading on WEEX comes with a 10%-20% profit split. Every time the trader you copy earns money for you, you will share a portion of the profits with the trader.

Demo Trading

WEEX offers demo trading, letting users practice futures strategies with virtual funds. The demo option mirrors live trading conditions, including real-time prices and order types. It’s a safe space to hone skills before jumping into real markets.

WEEX Trading Fees

WEEX charges 0.10% for both spot maker and taker fees, keeping costs predictable across all pairs. Futures fees are 0.02% for makers and 0.08% for takers, on the higher side for takers. Internal transfers between WEEX users are free, a nice touch for frequent traders. These fees suit altcoin and futures trading, though WXT offers no discounts.

| Fee Type | Maker Fee | Taker Fee |

|---|---|---|

| Spot Trading | 0.10% | 0.10% |

| Futures Trading | 0.02% | 0.08% |

Spot Trading Fees

Spot fees are set at 0.10% for both makers and takers. However, users can qualify for reduced rates based on their 30-day trading volume or WXT holdings. At the highest tier, traders reaching $100,000,000 in volume or holding 3,500,000 WXT may reduce spot fees to 0.00% for both maker and taker orders.

Futures Trading Fees

Futures fees are 0.02% for makers and 0.08% for takers. High leverage can increase costs, so plan carefully.

What we like about WEEX is its VIP program where traders unlock lower fees based on their 30-day futures trading volume. With fees as low as 0.024% for makers and 0.006% for takers, WEEX offers a generous fee structure for active futures traders. Additionally, users can receive lower fees when holding the WXT coin in their wallet.

WEEX Deposits & Withdrawals

WEEX sticks to cryptocurrencies, with no fiat currency support. Available deposit methods only include cryptocurrencies. Credit/Debit cards or bank transfers are not supported.

Withdrawals are also crypto-only. Deposit fees are typically $1 for TRC20 networks and $5 for Ethereum, while withdrawal fees vary by blockchain. Other cheap options include the Solana blockchain.

Without KYC, users can withdraw up to $50,000 daily, rising to $100,000 with Level 1 KYC. Higher KYC levels exist, but their limits are unclear. The crypto-only setup keeps things fast, with free internal transfers between WEEX users. Fiat users may find the lack of bank options a hurdle.

WEEX Deposit Methods & Fees

| Method | Fee |

|---|---|

| Cryptocurrencies (TRC20) | $1 |

| Cryptocurrencies (Ethereum) | $5 |

WEEX Withdrawal Methods & Fees

| Method | Fee |

|---|---|

| Cryptocurrencies (TRC20) | $1 |

| Cryptocurrencies (Ethereum) | $5 |

WEEX Customer Support

WEEX offers 24/7 support through live chat and email, handling account, trading, and technical queries. The team earns a 7/10 rating, with occasional delays reported. Support is available in 14 languages, including French and Russian, making it accessible to a global audience.

WEEX Security & Regulations

WEEX maintains a moderate safety profile but lacks clear regulatory licenses, based on available data. Operating from Singapore, it faces potential scrutiny in some regions. No major security breaches are reported, which is reassuring. The platform uses standard security practices to keep funds safe.

Exchange Security & Regulations

WEEX employs two-factor authentication, encryption, and cold storage to protect user assets. Without specific licenses, regulatory oversight is minimal, so check local rules before trading. No significant hacks or data breaches have surfaced, suggesting decent security.

Account Security

Account security includes 2FA via email or authenticator apps, plus encrypted data transfers. Enabling 2FA is a must to lock down your account against unauthorized access.

WEEX Alternatives

WEEX, Bitunix, and Bybit all target futures and altcoin traders, but they differ in key ways. WEEX offers no-KYC trading, 400x leverage, and 509+ coins, with a $17.89 billion futures volume, perfect for high-risk futures fans. Bitunix, also no-KYC, supports 408+ coins and $4.85 billion in futures volume, but its 125x leverage and $537.63 million spot volume make it less robust for spot trading. Bybit requires KYC, offers 726+ coins, and leads with $17.96 billion in futures volume, favoring those needing deep liquidity.

WEEX and Bitunix excel for altcoin traders due to no-KYC flexibility, while Bybit’s KYC and higher fees (0.10% spot) may turn off some. WEEX’s free internal transfers stand out, and its $20,000 bonus is generous. Bybit’s 30 million users and Dubai base signal stronger trust, but WEEX’s leverage edge draws futures traders. Here’s how they stack up:

| Feature | WEEX | Bitunix | Bybit |

|---|---|---|---|

| Spot Fees (Maker/Taker) | 0.10%/0.10% | 0.10%/0.10% | 0.10%/0.10% |

| Coins | 509+ | 408+ | 726+ |

| KYC | Not required | Not required | Required |

| Bonus | $20,000 | $5,500 | $30,000 |

| Futures Volume | $17.89B | $4.85B | $17.96B |

| Headquarters | Singapore | Dubai, UAE | Dubai, UAE |

| Users | 5M+ | 1M+ | 30M+ |

Conclusion

WEEX delivers a crypto powerhouse with over 509 coins and 400x futures leverage, tailor-made for altcoin and futures traders. Its $17.89 billion trading volume and no-KYC policy, allowing $50,000 daily withdrawals, draw privacy-conscious users. Spot fees are 0.10%, while futures fees are 0.02% for makers and 0.08% for takers, with free internal transfers saving costs. Copy trading and demo modes make it approachable for all levels.

The platform’s strengths lie in its leverage, asset variety, and 14-language support, from Thai to Italian. But no fiat support and vague company details are hurdles, and the moderate spot volume may not suit high-frequency spot traders. Since 2017, WEEX has carved a niche for those chasing big moves in crypto, especially futures. It’s a solid pick for traders who value leverage and anonymity over traditional banking.

FAQ

Q: Is KYC required on WEEX?

A: No, KYC is optional, with up to $50,000 daily withdrawals without verification.

Q: What are WEEX’s spot and futures fees?

A: Spot fees are 0.10% for makers and takers. Futures fees are 0.02% for makers and 0.08% for takers.

Q: Is WEEX available in the US?

A: No, WEEX is likely restricted in the US due to OFAC sanctions.

Q: How many coins can be traded on WEEX?

A: WEEX supports over 509+ cryptocurrencies for spot trading and 720 futures contracts.

Q: What leverage does WEEX offer?

A: WEEX offers up to 400x leverage for futures trading.

Q: What makes WEEX unique?

A: Free internal transfers and 14-language support, like Vietnamese and German, boost accessibility.