Summary

However, regulations have somewhat eased, and U.S. citizens can now buy Tether (USDT) in the US through exchanges registered with FinCEN as money services businesses. Exchanges like Coinbase, Kraken, and BYDFi fall under this category and can be used to buy USDT as well as trade crypto assets.

Can I Buy Tether (USDT) in the US?

Yes, U.S. citizens can buy Tether (USDT) in the U.S. through exchanges regulated by FinCEN, using multiple payment options. If you’re considering entering the crypto space through any of these exchanges, it’s important to keep in mind that regulatory conditions can be strict.

You must adhere to these regulations to ensure the safety of your assets. Key regulations include reporting crypto transactions over $10,000, treating crypto investments as taxable assets, and fulfilling KYC (Know Your Customer) requirements. In this guide, we’ll explore the exchanges that offer the best routes into crypto for U.S. citizens.

How to Buy Tether (USDT) in US Using Crypto Exchanges

To buy Tether (USDT) in the U.S., you can register with any FinCEN-registered exchange. Let’s explore some of the exchanges you can use:

Coinbase

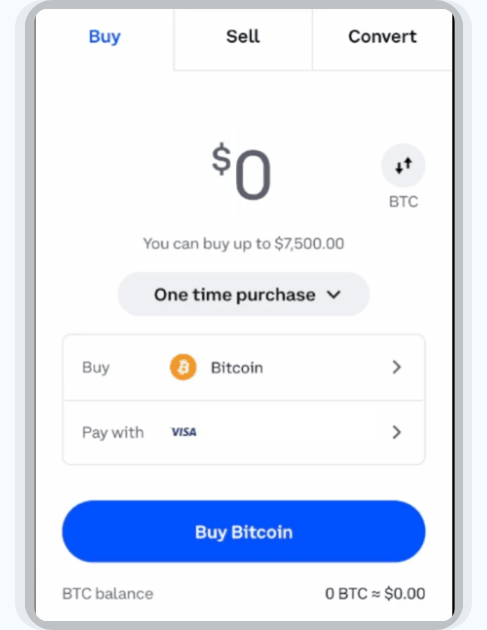

Coinbase is one of the most reliable crypto exchanges, serving over 108+ million users globally. It is a publicly traded company listed on the Nasdaq stock exchange under the ticker symbol COIN, making it the only crypto exchange on the stock market—a fact that highlights its credibility.

Coinbase offers a range of crypto services, including trading, Web3 wallets, staking, and the ability to buy USDT with USD to fund your account. With over 250+ crypto assets available for trading, Coinbase is a high-quality platform to buy Tether (USDT) in the U.S.

You can learn more about Coinbase in our review, where we discuss its products, services, and other key features in detail.

Best Alternatives to Coinbase for Buying Tether

Having alternatives is always a smart move. Keeping another account as a backup ensures you can switch to a different exchange if one is under maintenance or temporarily unavailable. Additionally, personal preferences for features and services might lead you to explore other options. With that in mind, here are the best alternatives to Coinbase for buying Tether (USDT) in the U.S.:

Kraken

One of the oldest and most reliable exchanges, Kraken allows you to buy Tether (USDT) in just a few steps. Regulated by FinCEN, Kraken serves over 9 million users and offers services similar to Coinbase, including trading, staking, and Web3 wallets. With more than 323 cryptocurrencies available for trading, Kraken stands out for its wide selection. In terms of security, Kraken utilizes advanced cold storage for most assets and secure hot wallets for transactions, ensuring your funds remain safe.

BYDFi

Launched in 2019, BYDFi is a non-KYC crypto platform operating under strict regulatory oversight. BYDFi holds dual Money Services Business (MSB) licenses regulated by FinCEN. Serving over 4 million customers, BYDFi allows users to trade over 418 cryptocurrencies on spot markets with low fees and offers futures trading with up to 200x leverage. BYDFi is another great option for U.S. citizens looking to buy and trade Tether (USDT) while adhering to U.S. regulations.

US Dollar (USD) to USDT Fees

For both Coinbase and Kraken, depositing and converting USD to USDT involves minimal fees and straightforward processes. On Coinbase, users can deposit funds via ACH transfers for free or use wire transfers for a $10 fee. Kraken offers similar options, with ACH deposits also being free, while FedWire deposits via Dart Bank or Etana Connect require a $10 minimum deposit but come with no additional fees

Is Tether (USDT) Legal in the US?

Yes, buying and selling Tether through regulated exchanges is completely safe and legal. Exchanges in the U.S. are strictly regulated by the SEC and FinCEN to ensure that U.S. citizens’ crypto investments remain secure. However, it’s important to remember that crypto gains are taxable. You’ll need to pay taxes on your gains once they are realized. Failure to comply with tax regulations can lead to penalties or legal issues, so staying up-to-date with your obligations is crucial.

Bottomline

Cryptocurrency in the U.S. has faced heavy scrutiny in the past, with the SEC closely monitoring every new crypto venture or exchange. The penalties imposed on XRP, Binance, and other notable crypto ventures created an atmosphere of caution and fear. However, things have changed significantly over the years. With the introduction of strict regulations, crypto is now legal to trade and own for U.S. citizens. So, if you’re looking to buy Tether (USDT) in the US to start your crypto investments, you can confidently do so through FinCEN-registered exchanges.

FAQs

1. Are there any restrictions on how much Tether (USDT) I can buy in the U.S.?

The amount of USDT you can purchase depends on the exchange and your account verification level. Higher verification tiers typically allow larger transaction limits.

2. What documents are required for KYC verification when buying Tether (USDT)?

Most exchanges require a government-issued ID (passport, driver’s license, or state ID) and proof of address (utility bill or bank statement) for KYC verification.

3. Can I use my debit or credit card to buy Tether (USDT) in the U.S.?

Yes, exchanges like Coinbase and Binance.US allow debit or credit card payments. Be aware of additional transaction fees when using this method.

4. Can I convert USDT to other cryptocurrencies directly on these platforms?

Yes, exchanges like Coinbase, Kraken, and Binance.US allow you to trade USDT for a variety of other cryptocurrencies using their spot trading features.

5. Do I need to report my USDT purchases to the IRS?

Purchasing USDT isn’t taxable, but gains from selling, trading, or using USDT must be reported to the IRS. Keep accurate records of all transactions for tax purposes.

6. How Much Tax Do I Pay on Cryptocurrency?

- Short-Term Gains: If you earned cryptocurrency or sold it after holding for less than 12 months, you’ll pay tax at your regular income tax rate, which ranges from 10% to 37%, depending on your income bracket.

- Long-Term Gains: If you sold cryptocurrency after holding it for over 12 months, you’ll pay a reduced tax rate of 0% to 20%, depending on your total taxable income.