Summary

Bitget enables users to buy crypto using their BBVA debit or credit cards or by directly depositing fiat through SEPA Instant, offering a range of cryptocurrencies to choose from.

Can I Buy Crypto with BBVA?

Yes, purchasing crypto using your BBVA bank account is possible. Although the bank does not provide direct cryptocurrency services, you can complete the transaction through a cryptocurrency exchange licensed by the Bank of Spain. The fees are typically minimal, and your choice of exchange depends on the range of cryptocurrencies you can purchase directly with BBVA.

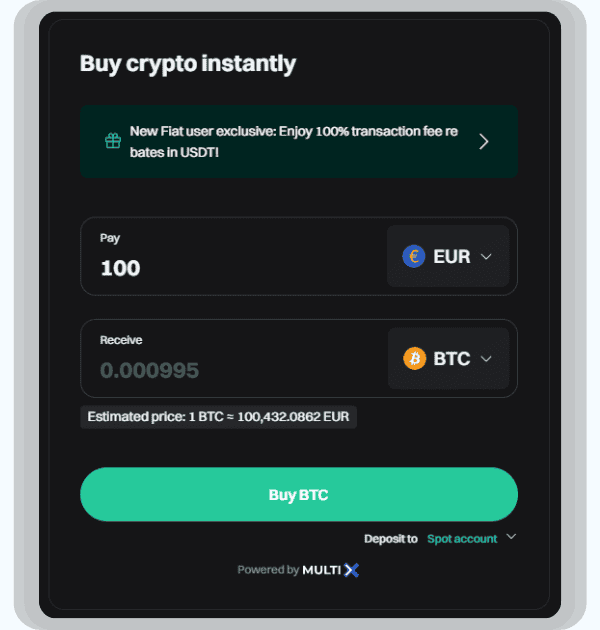

How to Buy Crypto with BBVA on Bitget

Bitget, established in 2018 by Sandra Lou, allows BBVA customers to deposit EUR to purchase crypto. Users looking to buy crypto with BBVA will find the buying process at Bitget not only simple but also accompanied by a variety of options to choose from while making their purchase. With over 871+ cryptocurrencies available on the spot market, Bitget offers additional products and services such as futures, bots, and earning platforms.

Users can also directly deposit EUR through SEPA Instant and then purchase crypto using their deposited funds. Since BBVA is among the banks that support SEPA, you can conveniently make your purchase using the direct deposit method as well.

Alternatives to Bitget

Having alternatives is always a great idea. Here are what we believe are the top alternatives to Bitget if you’re looking to buy crypto with BBVA:

Binance

Founded in 2017 by Changpeng Zhao, Binance is a leading crypto exchange offering 414+ cryptocurrencies, advanced trading tools, and competitive fees (0.1% spot). It supports futures, bot, and P2P trading, with a daily spot volume of $10.08 billion.

Coinbase

Launched in 2012 by Brian Armstrong, Coinbase is a highly regulated exchange focused on simplicity, making it beginner-friendly. It supports 250+ cryptocurrencies with fiat deposits in USD, EUR, and GBP, though fees are higher compared to alternatives.

What are the Fees?

Fees can vary depending on the exchange and the cryptocurrency you’re purchasing. On Bitget, we found the fee for buying BTC with EUR to be 1.8%, though the spread may range between 1-2%. However, these fees are separate from what BBVA might charge for money transfers. Bitget itself supports zero-fee deposits.

BBVA Cryptocurrency Policy

BBVA operates extensively across Europe and globally, offering secure fund transfer services to regulated exchanges in compliant regions. Currently, it provides a full range of crypto services only in Switzerland due to the country’s relaxed crypto regulations.

The inclusion of USDC highlights BBVA’s focus on compliance, as USDC aligns with the EU’s Markets in Crypto-Assets Regulation (MiCA). BBVA’s cryptocurrency policy is evolving with technological advancements, and as regulations ease across Europe, we may see its full range of services expand to other regions as well.

Bottomline

For anyone interested in cryptocurrency, seeing banking giants like BBVA start supporting it is a positive development, even though a full range of services is still limited. While direct crypto purchases aren’t yet available on the BBVA platform, you can easily buy crypto with BBVA through regulated exchanges like Bitget, either by making fiat deposits or using your credit/debit card.

FAQs

1. Can I use my BBVA debit or credit card for crypto purchases?

Yes, you can use your BBVA debit or credit card to buy crypto through regulated exchanges like Bitget or Binance. These platforms offer direct card payment options for convenient transactions.

2. Does BBVA charge additional fees for crypto transactions?

BBVA doesn’t charge specific fees for crypto transactions but may apply standard fees for SEPA transfers or card payments. Check with BBVA for exact charges based on your account type.

3. Is buying crypto with BBVA safe?

Yes, as long as you use regulated and secure exchanges. Ensure the platform complies with your country’s regulations and has robust security measures like KYC verification.

4. Why doesn’t BBVA offer direct cryptocurrency services?

BBVA currently offers crypto services only in Switzerland due to favorable regulations. In other regions, customers must use licensed exchanges to comply with local laws.

5. Can I sell crypto and withdraw funds to my BBVA account?

Yes, you can sell crypto on regulated exchanges and withdraw fiat directly to your BBVA account. Ensure the exchange supports SEPA withdrawals for seamless transactions.