Summary

Can I Buy Bitcoin with the Bank of Melbourne?

Unfortunately, no, you cannot directly buy Bitcoin or any other cryptocurrency using the Bank of Melbourne platforms. However, despite this limitation, the Bank of Melbourne is considered a crypto-friendly bank in Australia. Unlike some larger banks that impose significant restrictions on transactions to cryptocurrency exchanges, the Bank of Melbourne does not block such transactions.

Additionally, the bank’s Bitcoin Special Report, developed with the help of senior economist Jarek Kowcza, was a notable effort to educate Australian citizens about the nature of Bitcoin and its potential as a future payment method.

As mentioned, the Bank of Melbourne does not block transactions to crypto exchanges. This means you can deposit AUD to crypto exchanges and, in return, purchase Bitcoin or other cryptocurrencies on their platform.

How to Buy Crypto with Bank of Melbourne on Bitget

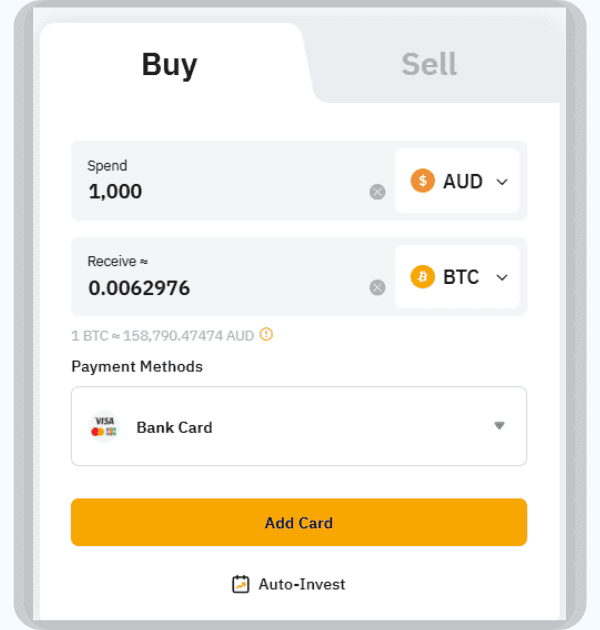

With Bybit, Bank of Melbourne users can easily deposit funds into their Bybit accounts or use their credit/debit cards to directly purchase Bitcoin or other cryptocurrencies. Bybit is a well-established platform, supporting over 660+ cryptocurrencies on spot, providing users in Australia with a platform to hold and trade cryptocurrencies.

Founded in 2018 by Ben Zhou, Bybit boasts a high security index and offers a diverse range of products and services, including bot trading, copy trading, and passive income opportunities. Compliant with AUSTRAC requirements, Bybit is an excellent choice for Australians looking to buy crypto using their Bank of Melbourne accounts and start their cryptocurrency investments.

Apart from purchasing cryptocurrency using your credit or debit card, Bybit also offers the option to deposit AUD into your Bybit account. This is a convenient choice if you’re currently only interested in funding your account and plan to purchase cryptocurrency at a later stage.

Alternatives to Bybit

If Bybit isn’t the right exchange for you—whether you can’t find a specific cryptocurrency, want higher leverage, or have other preferences—here are a few alternatives you might consider:

BloFin

One option is BloFin, established in 2019 by Matt Hu, with a user base of over 2 million. BloFin supports 394+ cryptocurrencies, offers high security, bot trading, and up to 125x leverage. Additionally, it does not require KYC, making it a convenient choice for users seeking privacy and efficiency.

MEXC

Another excellent option is MEXC, one of the best platforms for trading altcoins, with an impressive selection of over 2437+ coins available for spot trading. Established in 2018, MEXC boasts a user base of over 6 million and provides high-security measures along with up to 200x leverage. Like BloFin, MEXC also does not require KYC, making it a popular choice for Australian users looking for flexibility and extensive trading options.

What are the Fees?

The Bank of Melbourne doesn’t charge specific fees for online transactions with credit or debit cards. However, using a credit card for cryptocurrency purchases may incur a cash advance fee of around 3%, plus higher interest rates. For international transactions, a foreign transaction fee of 3% may apply, especially when using exchanges not registered with AUSTRAC.

On the other hand, Bybit charges 3.05% for Visa payments and 2.70% for Mastercard payments. These fees, combined with potential bank charges, are important to consider when buying cryptocurrency.

Bank of Melbourne Cryptocurrency Policy

The Bank of Melbourne (BOM) takes a crypto-friendly stance, allowing customers to engage in cryptocurrency transactions without strict restrictions. While the bank doesn’t provide a direct option to buy cryptocurrency, customers can use their BOM accounts, debit cards, or credit cards to fund purchases on third-party platforms, including regulated exchanges. However, credit card transactions may incur cash advance fees.

Unlike stricter policies from other Australian banks, such as transaction limits by Commonwealth Bank or heavy restrictions from NAB and ANZ, BOM’s approach is more flexible. As part of the Westpac Group, any future changes in its crypto policy may align with group-wide decisions.

Bottomline

Despite its crypto-friendly stance, Bank of Melbourne does not allow users to directly buy cryptocurrencies, similar to other Australian banks. To purchase crypto, users can deposit funds into third-party exchanges. It’s advisable to use AUSTRAC-licensed platforms to avoid future disruptions in crypto trading and potential issues with regulatory actions on non-compliant exchanges.

FAQs

1. Does the Bank of Melbourne restrict transactions to cryptocurrency exchanges?

No, the Bank of Melbourne is considered crypto-friendly and does not block transactions to cryptocurrency exchanges, allowing users to deposit AUD into platforms like Bybit or MEXC without significant restrictions.

2. Are there tax implications when buying crypto in Australia with Bank of Melbourne?

Yes, under Australian tax law, cryptocurrencies are considered assets. Transactions may be subject to capital gains tax (CGT). For example, if you sell cryptocurrency at a higher price than your purchase cost, the profit will be taxed. Ensure you maintain accurate records of all crypto transactions for tax reporting.

3. Why doesn’t the Bank of Melbourne offer direct cryptocurrency services?

Like most Australian banks, the Bank of Melbourne has not integrated crypto services into its offerings, likely due to regulatory complexities and the volatile nature of cryptocurrencies.

4. How can I reduce fees when buying cryptocurrency with the Bank of Melbourne?

To minimize costs, avoid using credit cards for purchases due to cash advance fees. Instead, deposit AUD directly into an exchange account and choose platforms with lower transaction fees, like Bybit’s AUD deposit option.

5. Can I use mobile banking with the Bank of Melbourne to fund crypto purchases?

Yes, the Bank of Melbourne’s mobile banking app can be used to transfer funds to exchanges that accept AUD deposits. Ensure you enter the correct details to avoid delays or errors.