Not every trader needs hundreds of coins or complex features. Coinflare, launched in 2022, focuses on core spot and futures trading with a fast interface and no mandatory KYC. With over 1 million users and steady derivatives volume, it positions itself as a lean, trading-first platform. In this Coinflare review, we examine its fees, leverage, features, security, and overall reliability.

Coinflare Overview

In this Coinflare Review, we share everything you need to know about the cryptocurrency exchange launched in 2022, led by CEO Wui Yang Ee. Headquartered in Singapore, Coinflare serves over 100 countries and has grown to support more than 1 million users. The platform handles a 24-hour spot trading volume of $40 million and a futures volume of $1.6 billion, totaling $1.64 billion. No KYC is required, making it a haven for traders who prioritize privacy.

Coinflare has no native token, unlike some competitors. It restricts access in countries like the United States, China, and Iran due to sanctions. A $5,000 trading bonus welcomes new users, giving a solid kickstart. With a user-friendly design, Coinflare aims to simplify crypto trading for a global audience. What we liked most about Coinflare is its reliability. The website is incredibly fast, ensuring a smooth crypto trading experience.

The main focus of Coinflare is spot and futures trading of popular cryptocurrencies such as BTC, ETH, XRP, and more. Other features include an “earn” program where users can earn passive income and an affiliate program. Features such as automated trading bots or copy trading are not supported.

Where Coinflare Stands Out

Coinflare grabs attention with its no-KYC policy and low trading fees, a combo that’s tough to beat for privacy-focused traders. The platform supports spot and futures trading with fees as low as 0.10% for spot and 0.022% / 0.060% for futures, keeping costs down. Its fast, responsive interface ensures smooth trading, even during market swings. Futures leverage up to 100x draws traders chasing big returns without heavy paperwork.

While limited to 10 cryptocurrencies, Coinflare’s focus on core coins like Bitcoin suits targeted trading. The $5,000 bonus adds real value for new sign-ups. As a newer exchange, its reputation is still building, and the small coin selection may not suit everyone. Coinflare’s lean, private approach makes it a sharp choice for focused crypto traders.

Coinflare Pros & Cons

| ✅ Coinflare Pros | ❌ Coinflare Cons |

|---|---|

| Low spot fees (0.10%) | Low number of supported coins |

| No KYC required | New exchange, limited reputation |

| 100x futures leverage | Restricted in US and China |

| Very user-friendly interface | No FIAT support |

| $5,000 trading bonus | Trading-focused, no extras |

Sign-up & KYC

Getting started on Coinflare is quick, with no KYC needed to begin trading. Users can sign up with an email and withdraw up to $5,000 daily without verification. Level 1 KYC, requiring ID and a live video check, boosts withdrawals to $50,000 daily. A $5,000 trading bonus gives new traders a head start.

No higher KYC levels exist, keeping the process simple. The no-KYC option is a big draw for those valuing privacy. Coinflare’s straightforward signup makes it easy to jump into trading.

Withdrawal Limits

Withdrawal limits at Coinflare depend on your KYC level. Unverified users can withdraw $5,000 on a daily basis, equal to $150,000 on a monthly basis. For higher withdrawal limits of up to $50,000 daily, Coinflare users must verify their identity.

| KYC Level | Daily Withdrawal Limit |

|---|---|

| No KYC | $5,000 |

| Level 1 KYC | $50,000 |

Coinflare Products, Features, & Services

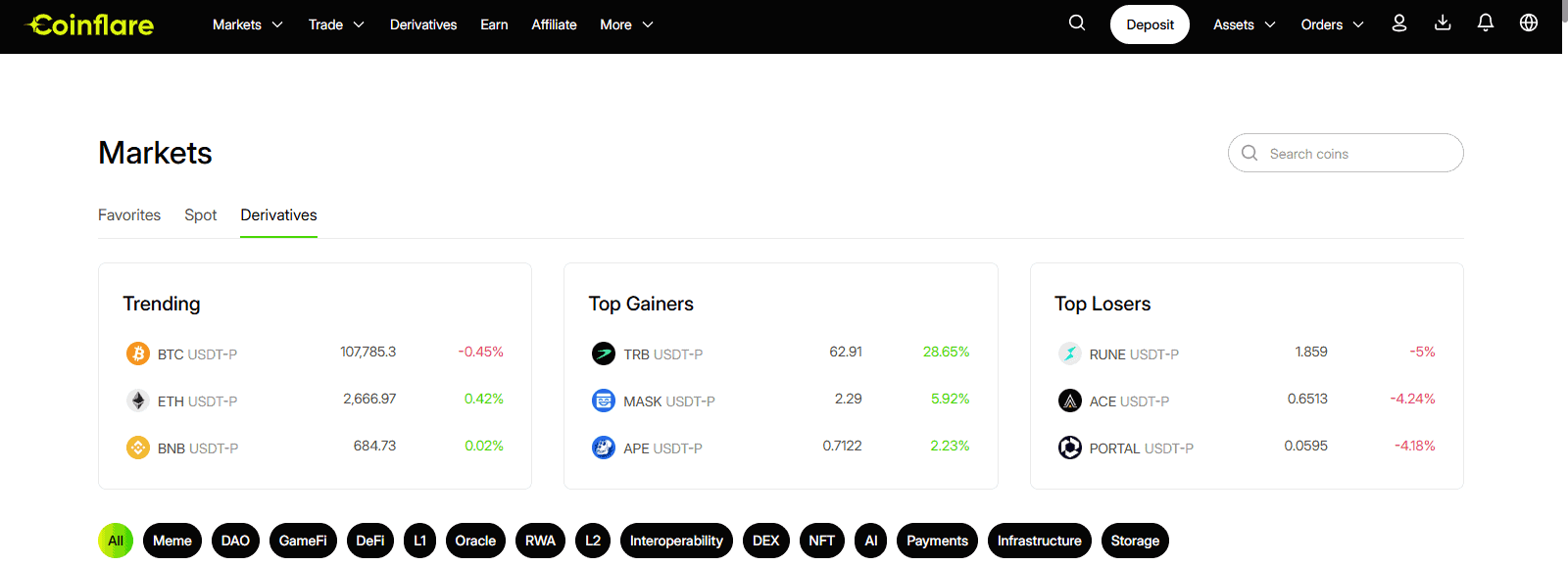

Coinflare offers a streamlined platform for spot and futures trading, supporting 10+ cryptocurrencies and over 81+ futures contracts. P2P trading allows direct crypto swaps, adding flexibility for users. The platform focuses on core trading products, skipping extras like staking or copy trading. Its fast, responsive UI ensures a smooth experience across the web and mobile.

An affiliate program pays a 50% commission, rewarding user referrals. Support is available 24/7 via live chat and email, rated highly at 9/10 for responsiveness. No fiat currencies are supported, so transactions are kept crypto-only. Coinflare’s lean approach prioritizes trading efficiency over bells and whistles.

The platform’s design is clean, with real-time market data for quick decisions. While limited in scope, its trading focus suits those who want simplicity. Coinflare’s no-KYC policy and high leverage make it attractive for active traders. It’s a solid pick for crypto purists who don’t need a sprawling feature set.

The key downside of Coinflare is the lack of additional features aside from trading. We are missing commonly offered features, such as copy trading, trading bots, demo trading, and staking. However, Coinflare has developed an excellent environment for crypto traders seeking spot and futures trading activities.

Coinflare Supported Assets

Coinflare supports 10 cryptocurrencies for spot trading, including major coins like Bitcoin and Ethereum. Futures trading offers over 81+ contracts with up to 100x leverage, appealing to high-risk traders. No native token exists, and stocks, commodities, forex, or options trading are not supported, focusing solely on crypto.

No margin trading is available for spot, limiting leverage options. Coinflare’s small but curated asset range suits traders focused on core cryptocurrencies. The platform’s futures leverage adds punch for those diving into derivatives.

Coinflare Trading Options

Coinflare delivers spot and futures trading, with a 24-hour spot volume of $40 million and a futures volume of $1.6 billion. It supports 10 cryptocurrencies for spot trading and over 81+ futures contracts, offering a focused trading experience. Futures trading includes 100x leverage, a draw for those chasing big moves. P2P trading enables direct crypto exchanges, adding versatility.

No copy trading, bot trading, demo trading, staking, stocks, commodities, forex, or options are available, keeping the platform lean. The interface is fast and responsive, with real-time charts and order books for efficient trading. Coinflare’s trading is tailored for core crypto markets, prioritizing speed and simplicity.

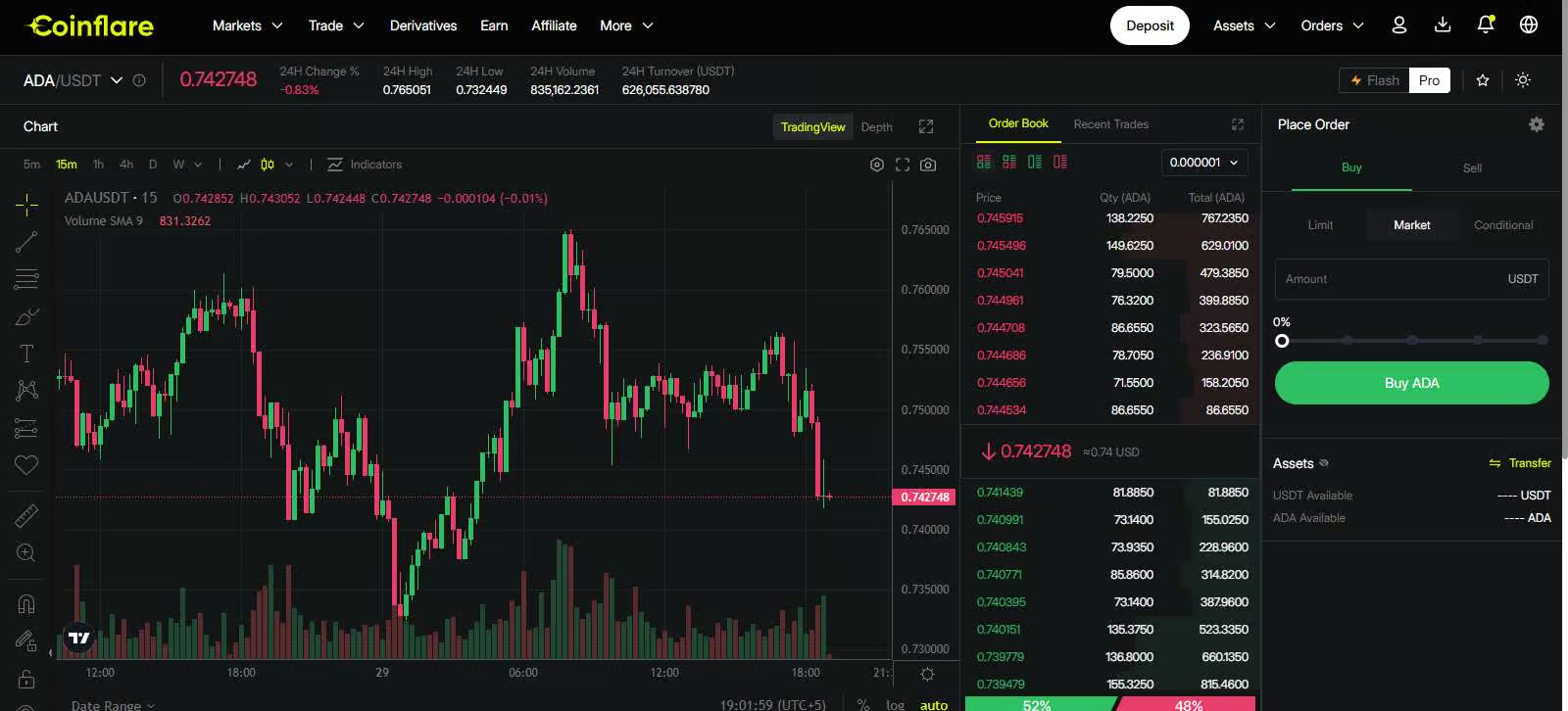

Spot trading is straightforward, with low fees and a clean dashboard. Futures trading stands out for its leverage, though the contract count is modest. The platform’s no-KYC policy makes it accessible, but the small coin selection may not suit traders seeking variety. Coinflare’s focus on trading efficiency makes it a sharp tool for those who know what they want.

Spot Trading

Coinflare’s spot trading supports 10 cryptocurrencies, including Bitcoin and Ethereum. The 24-hour spot volume of $40 million offers modest liquidity. No margin trading limits leverage options, but the UI is user-friendly.

Supported order types include:

- Market orders

- Limit orders

- Conditional orders

These options cover basic spot trading needs.

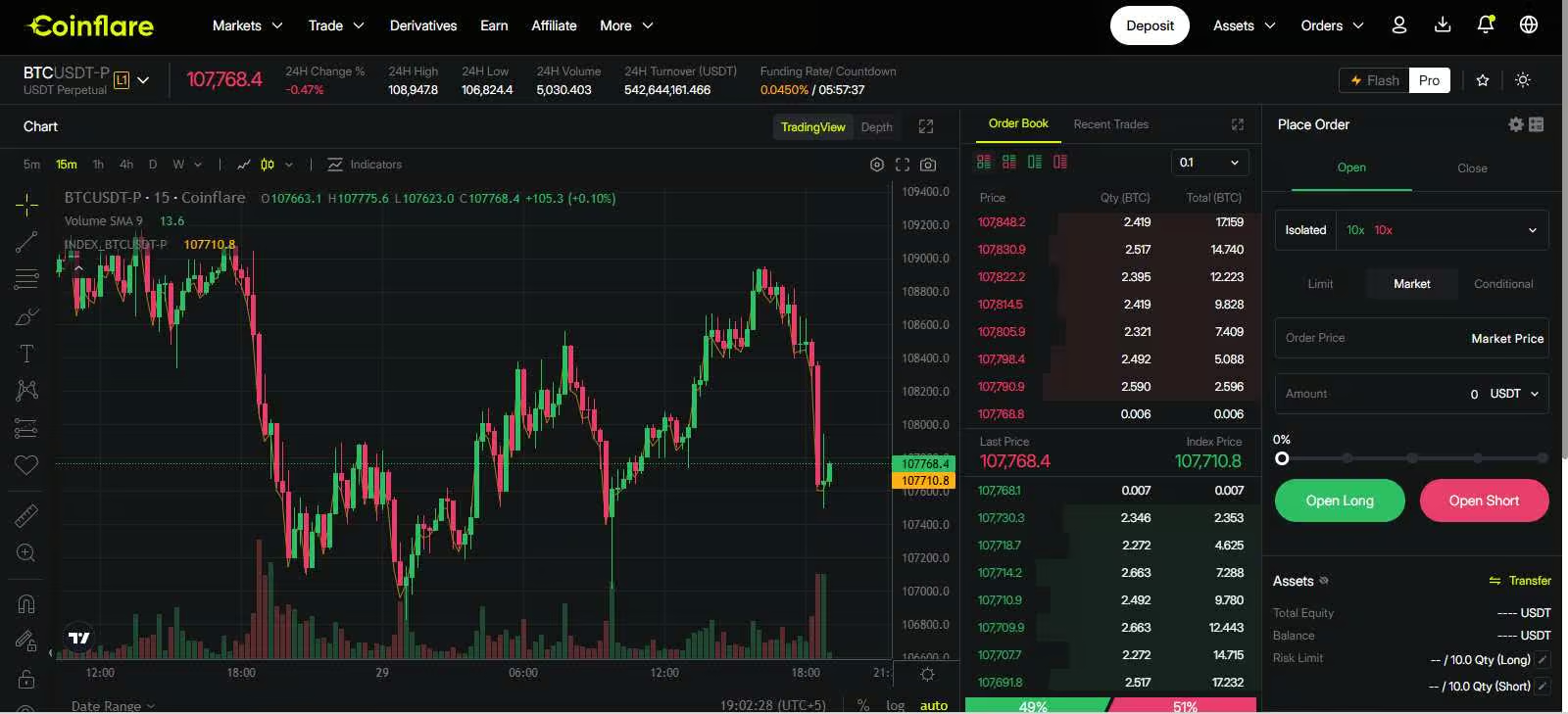

Futures Trading

Coinflare’s futures trading supports over 100 contracts, with a $1.6 billion 24-hour volume. Leverage up to 100x targets high-risk traders, with perpetual contracts for flexibility. The contract range is solid for a newer platform, offering up to 81 perpetual contracts settled in USDT. Inverse perpetual futures contracts are not available.

Supported order types for futures trading at Coinflare include:

- Market orders

- Limit orders

- Post Only

- Good Till Cancelled (GTC)

- Immediate or Cancel (IOC)

- Fill or Kill (FOK)

- Conditional orders

With real time TradingView charts directly integrated into Coinflare, users can conduct analysis right on the platform without having to use third-party tools. A real-time order book and recent trade history is also available.

Additionally, Coinflare offers a “Flash” version and a “Pro” version of their interface. The Pro version is recommended for experienced traders, seeking advanced tools and settings. The “Flash” interface could be a great option for beginners, seeking a simplified user interface.

Coinflare Trading Fees

Coinflare charges 0.10% for both spot maker and taker fees, competitive for spot trading. Futures fees are 0.022% for makers and 0.060% for takers, reasonable for derivatives. These fees apply across all pairs, with no token discounts. The low fees make Coinflare cost-effective, especially for futures traders.

| Fee Type | Maker Fee | Taker Fee |

|---|---|---|

| Spot Trading | 0.10% | 0.10% |

| Futures Trading | 0.022% | 0.060% |

Spot Trading Fees

Spot fees are 0.10% for makers and takers, consistent for all cryptocurrencies. This rate keeps spot trading affordable.

Futures Trading Fees

Futures fees are 0.022% for makers and 0.060% for takers. High leverage can amplify costs, so trade carefully.

Based on your 30-day trading volume, users can unlock lower fees. The lowest fee tier is unlocked at VIP6, which sets your maker fees to 0% and taker fees to 0.03%

Coinflare Deposits & Withdrawals

Coinflare is crypto-only, with no fiat currency support. Available deposit methods only include cryptocurrencies. Credit or debit cards are not supported.

Withdrawals are crypto-only. Deposit fees are $1 for TRC20 networks and $5 for Ethereum; withdrawal fees match these rates.

No KYC users can withdraw up to $5,000 daily, rising to $50,000 with Level 1 KYC. No higher KYC levels exist, keeping things simple. The crypto focus ensures fast transactions, but no fiat options may limit some users. Coinflare’s low fees make deposits and withdrawals cost-effective.

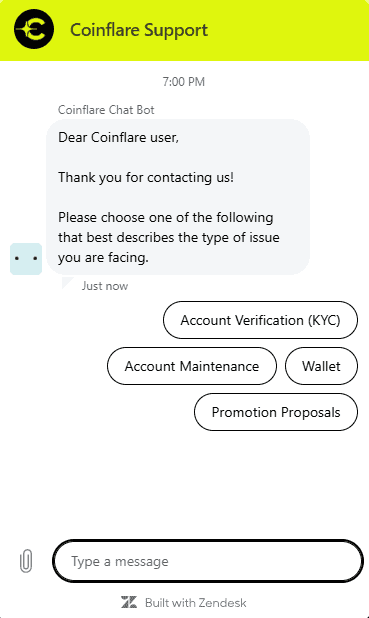

Coinflare Customer Support

Coinflare provides 24/7 support via live chat and email, handling trading and technical queries. The support team earns a 9/10 rating for responsiveness, a strong mark for a new exchange. Language support details are unclear, but the global reach suggests multiple options. Traders can expect quick, reliable help.

Coinflare Security & Regulations

Coinflare holds an above-average safety rating, with no reported breaches since 2022. Based in Singapore, it lacks specific regulatory licenses, common for new exchanges. Security measures are standard, ensuring fund protection. Traders should verify local laws due to the platform’s sanction restrictions.

Exchange Security & Regulations

Coinflare uses two-factor authentication, encryption, and cold storage to safeguard assets. Without licenses, regulatory oversight is minimal, so check local rules. The clean security record is a positive sign for a young platform.

Account Security

Account security includes 2FA via email or apps and encrypted data transfers. Enabling 2FA is essential to prevent unauthorized access, keeping accounts secure.

Coinflare Alternatives

Coinflare, Bitunix, Bitget, and WEEX serve futures and altcoin traders, but each has distinct edges. Coinflare’s no-KYC policy, 10 coins, and 0.10% spot fees suit focused traders, with $1.6 billion in futures volume. Bitunix, no-KYC, offers 408+ coins and $4.85 billion in futures volume, better for altcoin variety. Bitget requires KYC, supports 614+ coins, and has $9.61 billion in futures volume, ideal for liquidity. WEEX, no-KYC, offers 509+ coins and 400x leverage, with $17.89 billion in futures volume, excelling for high-risk futures.

Coinflare and Bitunix are great for no-KYC altcoin trading, while Bitget’s KYC and WEEX’s leverage cater to different needs. Coinflare’s small coin count limits options, but its low fees are a draw. Here’s how they compare:

| Feature | Coinflare | Bitunix | Bitget | WEEX |

|---|---|---|---|---|

| Spot Fees (Maker/Taker) | 0.10%/0.10% | 0.10%/0.10% | 0.10%/0.10% | 0.10%/0.10% |

| Futures Fees (Maker/Taker) | 0.022%/0.060% | 0.02%/0.06% | 0.02%/0.06% | 0.02%/0.08% |

| Coins | 10+ | 408+ | 614+ | 509+ |

| KYC | Not required | Not required | Required | Not required |

| Bonus | $5,000 | $5,500 | $20,000 | $20,000 |

| Futures Volume | $1.6B | $4.85B | $9.61B | $17.89B |

| Headquarters | Singapore | Dubai, UAE | Singapore | Singapore |

| Users | 1M+ | 1M+ | 8M+ | 5M+ |

Conclusion

Coinflare supports 10 cryptocurrencies and over 81+ futures contracts, with $1.6 billion in futures volume, ideal for focused traders. Spot fees are 0.10%, and futures fees are 0.022%/0.060%, keeping costs low. No KYC allows $5,000 daily withdrawals, and a $5,000 bonus adds value. P2P trading and a responsive UI enhance flexibility, but only 10 coins and no fiat support are limitations.

The platform’s strengths include anonymity, low fees, high leverage, and a fast interface, perfect for crypto purists. Its newness since 2022 and lack of regulation raise caution, and the small coin selection may not suit all. Coinflare is best for traders who want privacy and core crypto trading without extras.

FAQs

Q: Is KYC required on Coinflare?

A: No, KYC is optional, with up to $5,000 daily withdrawals without verification.

Q: What are Coinflare’s spot and futures fees?

A: Spot fees are 0.10% for makers and takers. Futures fees are 0.022% for makers and 0.060% for takers.

Q: Is Coinflare available in the US?

A: No, Coinflare is restricted in the United States, per its terms.

Q: How many coins can be traded on Coinflare?

A: Coinflare supports 10+ cryptocurrencies for spot trading and over 81+ futures contracts.

Q: What leverage does Coinflare offer?

A: Coinflare offers up to 100x leverage for futures trading.

Q: What makes Coinflare unique?

A: Coinflare’s no-KYC policy, low fees, and fast UI make it a streamlined choice for core crypto trading.