Coinbase Overview

Coinbase is one of the largest and oldest crypto exchanges and was launched by Brian Armstrong in 2012. The platform quickly became one of the largest global players, with over 108 million users and strong regulatory standings, including in the United States.

In this Coinbase review, we will show you everything you need to know, like features, trading options, supported assets, fees, security, customer support, and more.

Coinbase Pros & Cons

| ✅ Coinbase Pros | ❌ Coinbase Cons |

|---|---|

|

|

|

|

|

|

|

|

|

Coinbase Products & Services

Coinbase is one of the oldest crypto exchanges with tons of products and features. Traders can access spot trading for 375+ crypto assets on the main exchange. In addition to centralized spot markets, Coinbase also provides access to its onchain trading experience through Coinbase Wallet and the integrated DEX on the Base network, allowing users to trade Base ecosystem tokens directly. For experienced crypto futures traders, Coinbase offers their “Coinbase Pro” service with up to 10x leverage for 215+ assets.

What makes Coinbase stand out most is its regulatory standing. Coinbase is regulated in the United States and operates in over 150 different countries.

If you don’t own cryptos yet, you can easily deposit funds on Coinbase using your credit/debit card or bank transfer. Over 40 fiat currencies are supported for instant purchases. For selected currencies such as Euros, users can even deposit fiat using SEPA transfer.

For mobile users, Coinbase offers an app. The app is available for Android and iOS phones with a 4.2/5 star rating. After testing over 50 crypto exchange apps, we consider the Coinbase app to be perfect for beginners, but it is below average for experienced traders.

Coinbase Trading Features

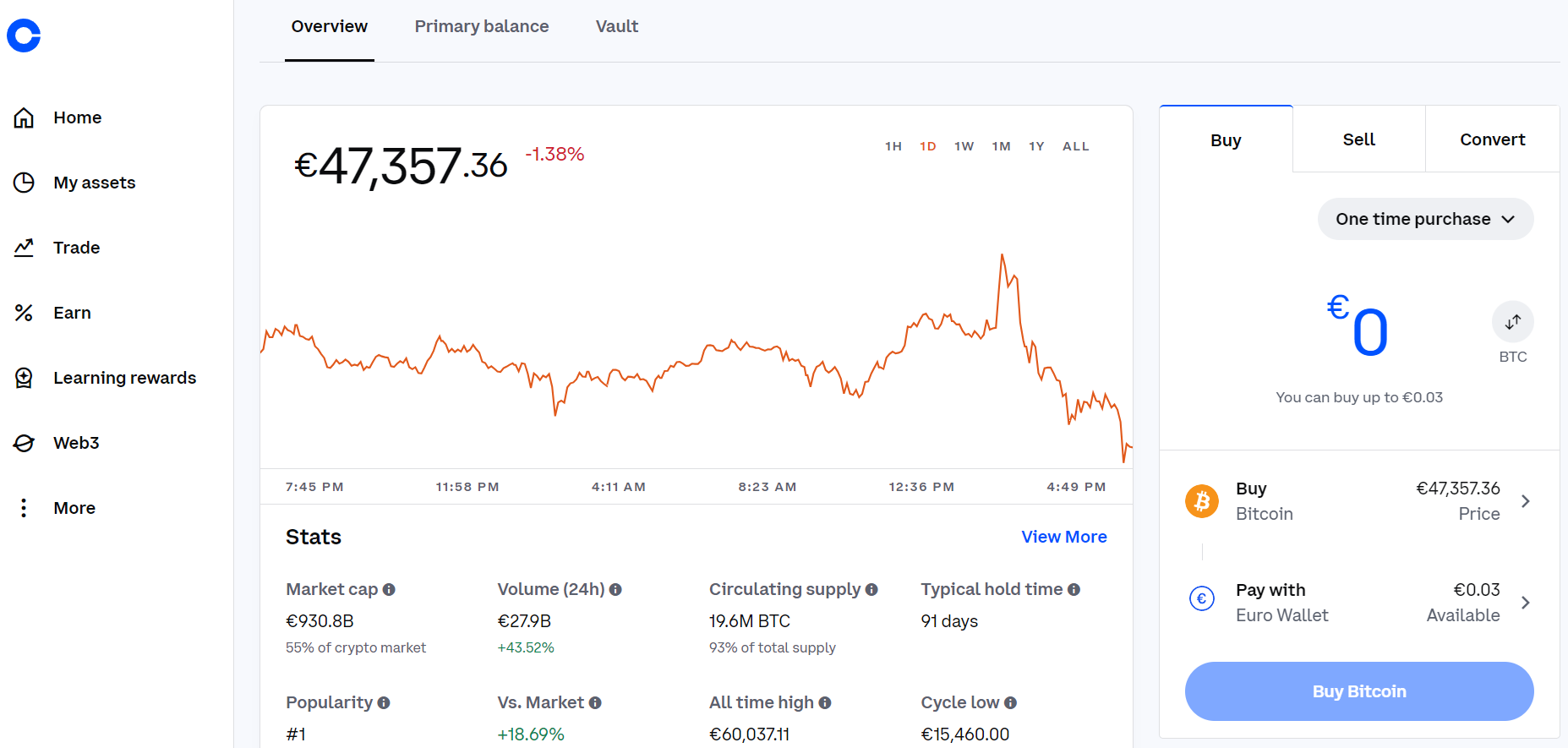

Spot Trading

Coinbase offers spot trading for over 375+ different coins. The interface is very user-friendly, making Coinbase a great choice for beginners who want to get started in the crypt market.

On the flipside, Coinbase has very high fees with limited order types, making it a rather poor choice for advanced traders. When execution large orders on Coinbase, users will experience a lot of slippage.

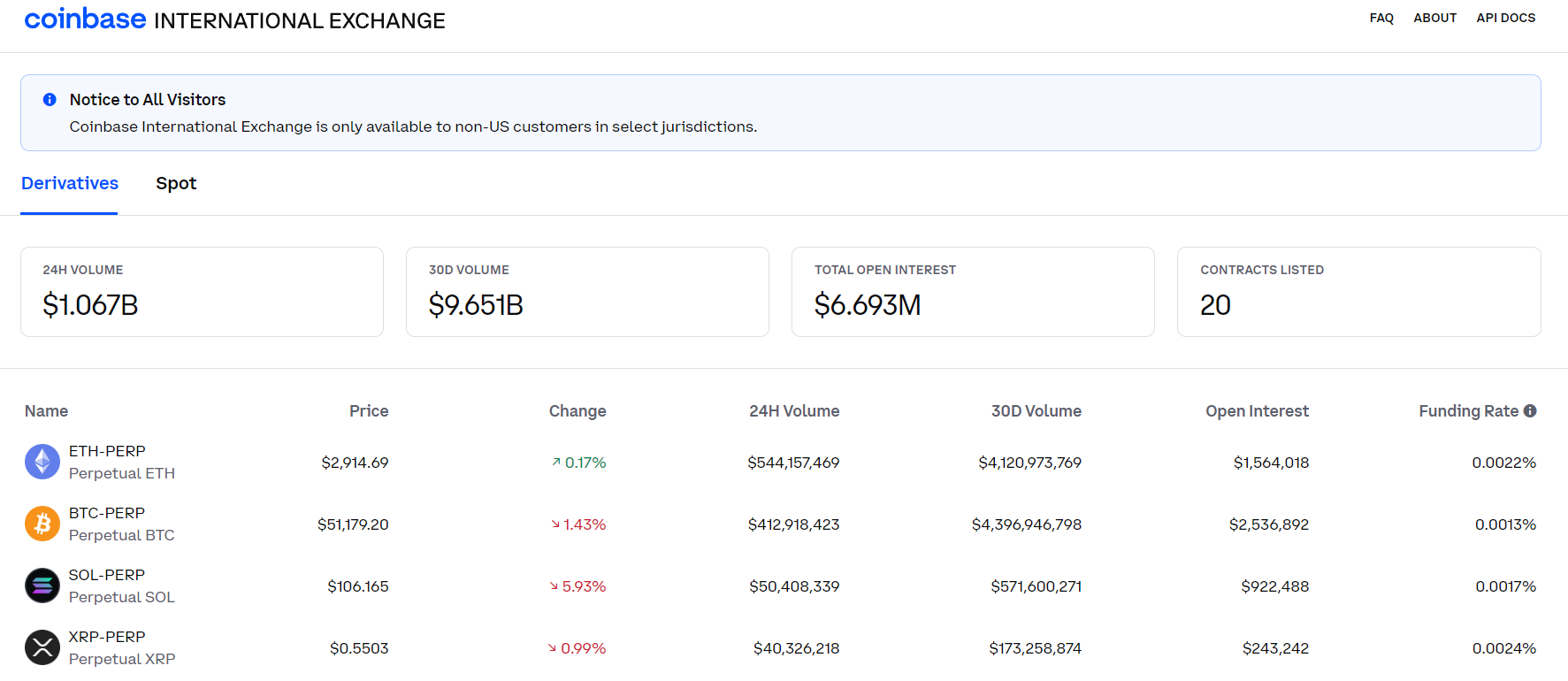

Futures Trading (Coinbase Pro International Exchange)

For experienced traders, Coinbase offers a high-performance derivatives trading platform with futures contracts trading for over 215+ different cryptos. The maximum leverage is 10x on selected assets such as Bitcoin, Ripple, or Ethereum.

While the Coinbase futures market has all the basic features you require, experienced traders may lack advanced order types and sufficient liquidity.

Coinbase Fees & Costs

Spot Trading Fees

Coinbase charges 0.4% maker and 0.6% taker fees on the spot market, making it a very expensive option. However, based on your 30-day trading volume, you can reduce your fees to as low as 0% maker and 0.05% taker (at $400M+ volume).

Futures Trading Fees

Coinbase International Futures Exchanges fees start at 0.05% for both maker and taker fees, making Coinbase the most expensive futures exchange. Even with the fee discounts, you will overpay by a lot compared to other crypto futures exchanges.

Coinbase Deposits & Withdrawals

Deposits

Coinbase supports multiple networks for free crypto deposits.

For fiat deposits, Coinbase supports over 40 fiat currencies, including USD, EUR, GBP RUB, and more, through the following payment methods:

- Credit/Debit card

- Bank transfer

- Sofort

Fiat deposit fees range from 1% to 3% based on your fiat currency and payment method.

Withdrawals

The Coinbase crypto withdrawal fees are dynamic and are based on the respective network capacity. Note that TRC-20 and BEP-20 are not supported.

Coinbase supports multiple networks for crypto withdrawals, including:

- Bitcoin

- ERC20

- MATIC

- Litecoin

- XRP

- SOL

For fiat withdrawals, Coinbase supports withdrawals via Bank transfer.

Coinbase Customer Support

Coinbase offers 24/7 live customer support via live chat. The average response time is 5 minutes. Overall, the Coinbase staff seems to be knowledgeable and helpful.

Coinbase Security

Coinbase complies with the laws and regulations of the Department of the Treasury’s Office of Foreign Assets Control.

In Europe, Coinbase is regulated by the Central Bank of Ireland as a virtual asset provider with the registration number C455715.

Coinbase stores customer funds in multi sig cold storage wallets. While we consider Coinbase to be a secure crypto exchange, we advise you to store your cryptos in a personal wallet.

You can also add additional security features to safeguard your account:

- Two-factor authentication

- Email verification

- SMS verification

Coinbase Sign up & KYC

Coinbase requires KYC verification. Without KYC verification, you can not use Coinbase. In order to verify your identity, you must submit personal details:

- Personal Details

- Government-issued ID

- Selfie

- Proof of address

Coinbase Review Summary

Coinbase is one of the oldest and most reliable crypto platforms. The exchange offers over 375+ different cryptocurrencies. Additionally, Coinbase Pro or International Exchange offers futures trading with 10x leverage for 215+ coins.

Due to high fees and poor liquidity, we can’t recommend day trading on Coinbase. However, for beginners, we think Coinbase is an excellent choice due to its user-friendliness and high security level.

The 24/7 live chat support is reliable and quickly assists when encountering an issue.

Overall, we consider Coinbase to be a top choice for beginners and passive investors who don’t want to day trade.

FAQ

1. Is Coinbase legit?

Yes, Coinbase is a legitimate crypto exchange with over 108 million users.

2. Does Coinbase require KYC?

Yes, Coinbase requires KYC verification. Without identification, you can not use Coinbase.

3. Is Coinbase available in the US?

Yes, Coinbase is available in the United States.

4. What are Coinbase fees?

Coinbase spot fees are 0.4% for makers and 0.6% for takers. Coinbase Pro futures fees are 0.2% maker and 0.4% taker.