BYDFi Overview

BYDFi was established in 2019. The founder and current CEO is Michael Hung. While the specific headquarters location is listed as potentially Singapore, the exchange operates globally, supporting users in over 100 countries. However, it does restrict users from certain locations, including China, Pakistan, Bangladesh, Kazakhstan, the United Kingdom, and Iran.

The platform serves a user base exceeding 4 million individuals. BYDFi does not feature its own native exchange token. The exchange operates without mandatory Know Your Customer (KYC) requirements for basic usage. Its combined 24-hour trading volume, considering both spot and futures markets, is approximately $5.76 billion ($211.71 million in spot and $5.6 billion in futures), indicating significant activity, particularly in its derivatives market. Information regarding the number of employees was not available.

Where BYDFi Stands Out

BYDFi distinguishes itself primarily through its approach to user verification and its derivatives trading capabilities. A key characteristic is the absence of mandatory KYC for basic operations, which appeals to users prioritizing privacy or those residing in regions where providing documentation might be difficult. This aspect is highlighted as particularly beneficial for traders in the USA, Canada, and the UK, despite some of these countries being listed as generally restricted, suggesting potential accessibility for certain services or user types.

The platform offers exceptionally high leverage for futures trading, reaching up to 200x, catering to traders seeking amplified exposure. Furthermore, the spot trading fee structure is noteworthy, featuring a 0.10% maker fee, eliminating costs for liquidity providers on the spot market. Additional features include automated trading through Grid and Martingale bots. While its futures volume is substantial ($5.6 billion), the spot market volume is considerably lower ($211.71 million). Potential users should note the limitation of cryptocurrency-only withdrawals and the restrictions placed on users from several key countries.

BYDFi Products, Features, & Services

BYDFi provides a suite of trading products and services tailored to different user needs. Core offerings include spot trading, allowing users to buy and sell cryptocurrencies at current market prices, and futures trading, enabling speculation on price movements with high leverage options. The platform supports over 324+ cryptocurrencies for spot trading and provides access to more than 480+ futures contracts.

In addition to direct trading, BYDFi incorporates Peer-to-Peer (P2P) trading functionality, facilitating direct transactions between users. For those looking to practice strategies without financial risk, a Demo Trading account is available. Automation is supported via specific trading bots, namely Grid and Martingale bots, which execute predefined strategies automatically. An affiliate program is also offered, providing a 40% commission rate for referred users.

Deposits can be made using a variety of methods, including direct cryptocurrency transfers, credit/debit cards, bank transfers, SEPA, and integrations with third-party payment providers like Transak, Banxa, and Alchemy Pay. However, withdrawals are restricted solely to cryptocurrencies. The platform supports several major fiat currencies like GBP, EUR, and USD for purchase activities via these third-party providers but does not support direct fiat withdrawals to bank accounts. The platform does not offer options trading, forex trading, commodity trading, stock trading, or staking services.

BYDFi Pros & Cons

| ✅ BYDFi Pros | ❌ BYDFi Cons |

|---|---|

|

|

Sign up & KYC

Signing up on BYDFi is straightforward. The platform stands out by not requiring mandatory Know Your Customer (KYC) verification for users to start trading or make withdrawals up to a certain limit. This approach caters to users prioritizing privacy or facing difficulties with documentation. New users might be eligible for a trading bonus, listed as $300, which typically requires completing specific registration or initial trading tasks.

While KYC is not mandatory for basic use, verifying identity unlocks higher withdrawal limits. Without KYC, users can withdraw up to 1 BTC daily. Completing Level 1 KYC increases this limit to 1.5 BTC per day. Level 2 and Level 3 KYC verification do not offer further increases beyond the Level 1 limit of 1.5 BTC daily.

Withdrawal Limits

| KYC Level | Daily Withdrawal Limit |

|---|---|

| No KYC | 1 BTC |

| Level 1 KYC | 1.5 BTC |

| Level 2 KYC | 1.5 BTC |

| Level 3 KYC | 1.5 BTC |

BYDFi Supported Assets

BYDFi provides access to a considerable range of digital assets, primarily focusing on cryptocurrencies. For spot trading, the platform supports over 324+ different cryptocurrencies, offering a wide selection for direct buying and selling. In the futures market, users can trade more than 480+ perpetual contracts, allowing speculation on the price movements of various underlying crypto assets.

The exchange does not have its own native token. Trading is centered around digital assets; BYDFi does not support trading for traditional assets like stocks, commodities, or forex. Options trading is also not available. High leverage is a key feature for futures, with a maximum of 200x available. For spot trading, there is no margin trading support indicated. A demo trading environment is provided, allowing users to test strategies with virtual funds before committing real capital. The platform’s asset focus remains firmly within the cryptocurrency space.

BYDFi Trading Options

BYDFi offers several ways for users to engage with the cryptocurrency markets, focusing mainly on spot and futures trading, complemented by automated and P2P options.

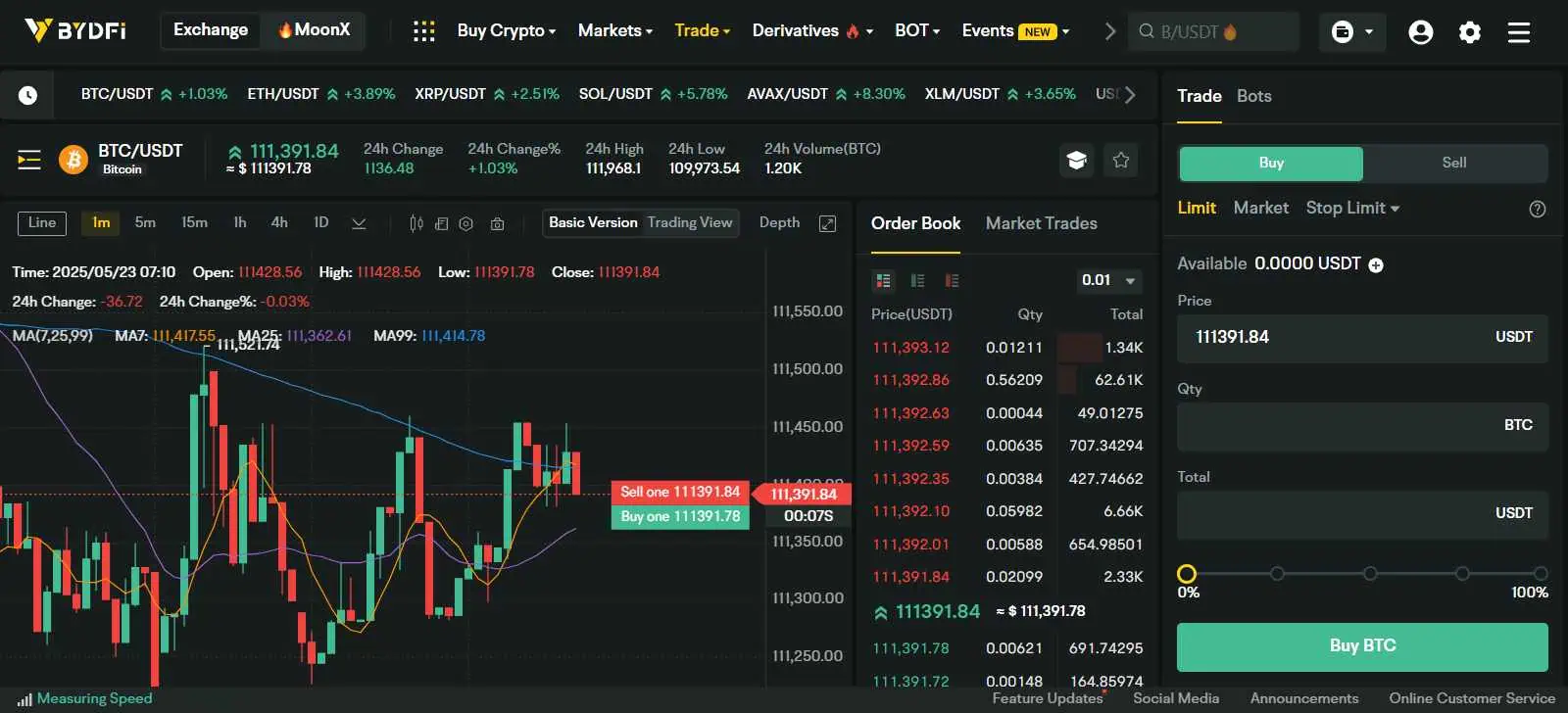

Spot Trading

The spot market allows users to buy and sell cryptocurrencies for immediate delivery. BYDFi supports over 324+ cryptocurrencies in its spot market, providing a broad selection for traders. The 24-hour spot trading volume was reported at $211.71 million, which indicates moderate liquidity compared to its futures market. The fee structure for spot trading is particularly attractive for makers (users adding liquidity to the order book) with a 0.10% fee. Takers (users removing liquidity) are charged a 0.10% fee. Margin trading is not supported on the spot market.

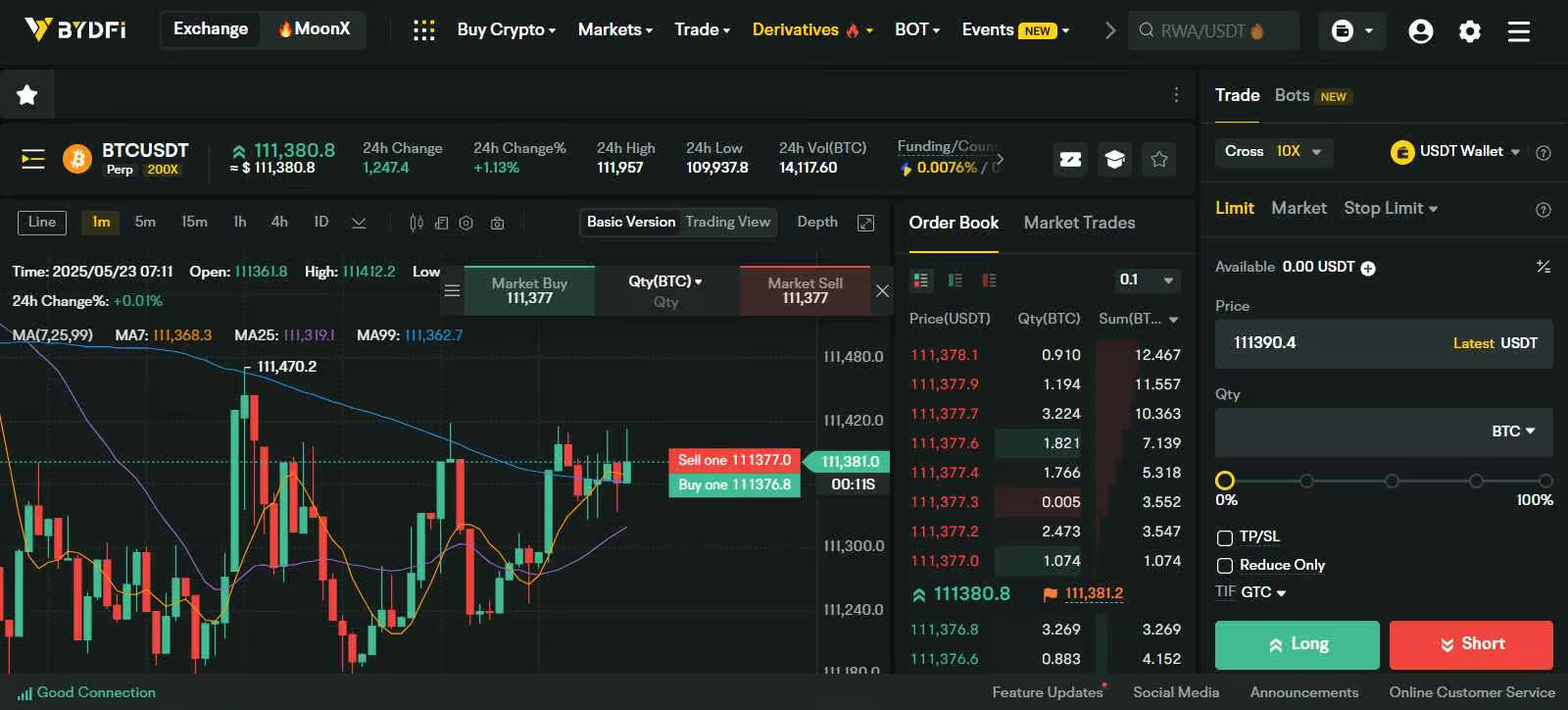

Futures Trading

Futures trading is a major focus for BYDFi, evidenced by its significant 24-hour volume of $5.6 billion. The platform offers over 480+ futures contracts, primarily perpetual swaps, which do not have an expiry date.

The standout feature here is the high maximum leverage offered, up to 200x. This allows traders to control larger positions with smaller amounts of capital, though it significantly increases risk. The fees for futures trading are 0.020% for makers and 0.060% for takers, which are competitive rates within the industry.

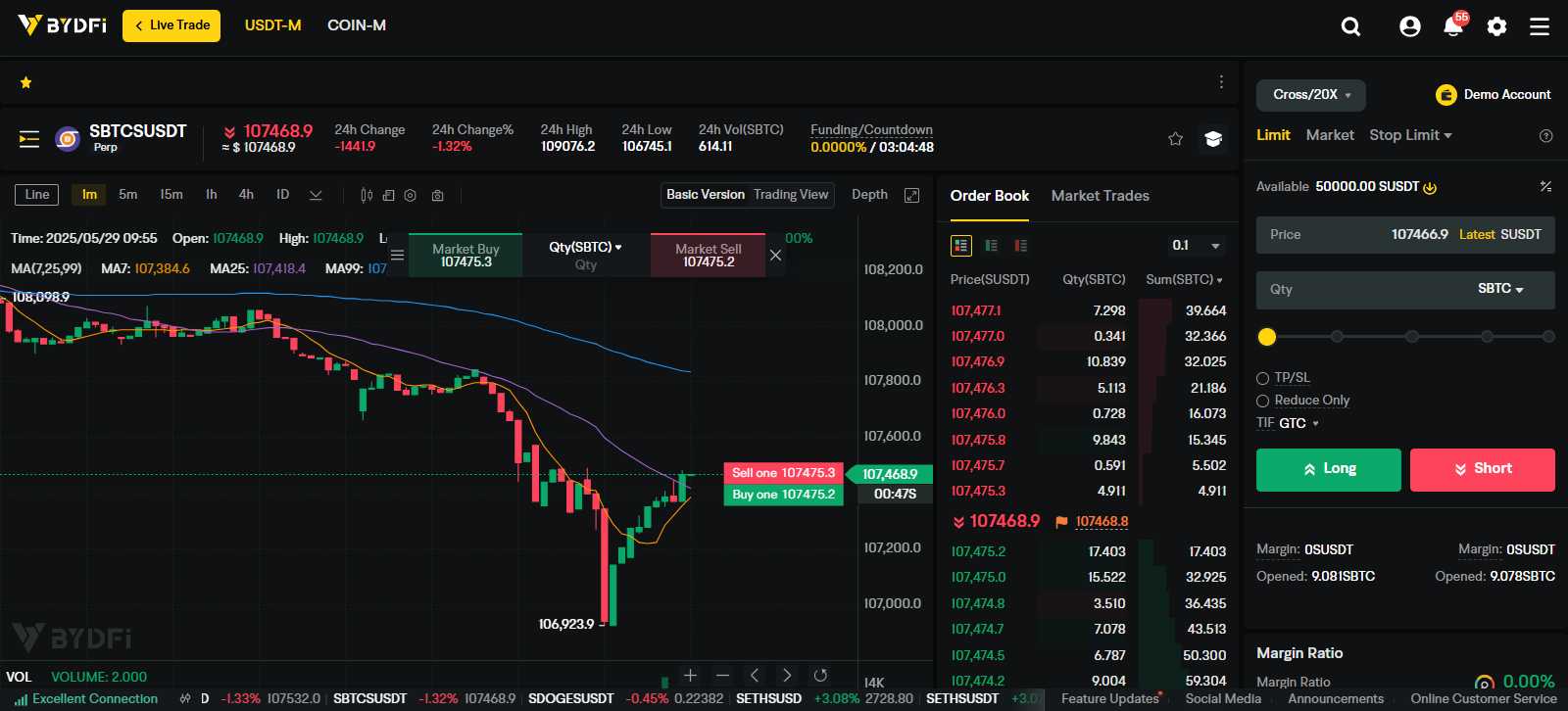

Demo Trading

For users new to trading or wanting to test strategies without risking real funds, BYDFi offers a demo trading account. This feature allows users to simulate trading in real market conditions using virtual currency, providing a valuable tool for learning and practice.

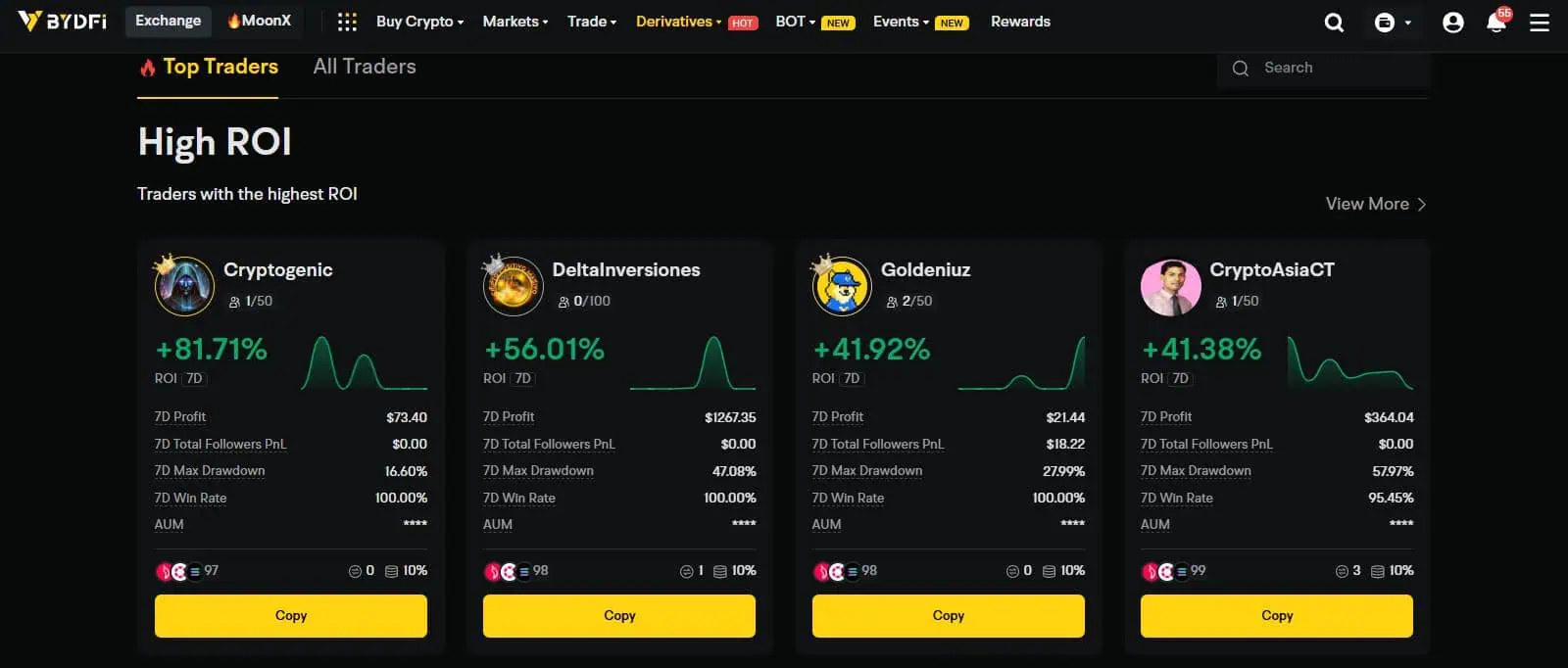

Copy Trading

BYDFi does not offer a copy trading feature. Users cannot automatically replicate the trades of other successful traders on the platform.

Bot Trading

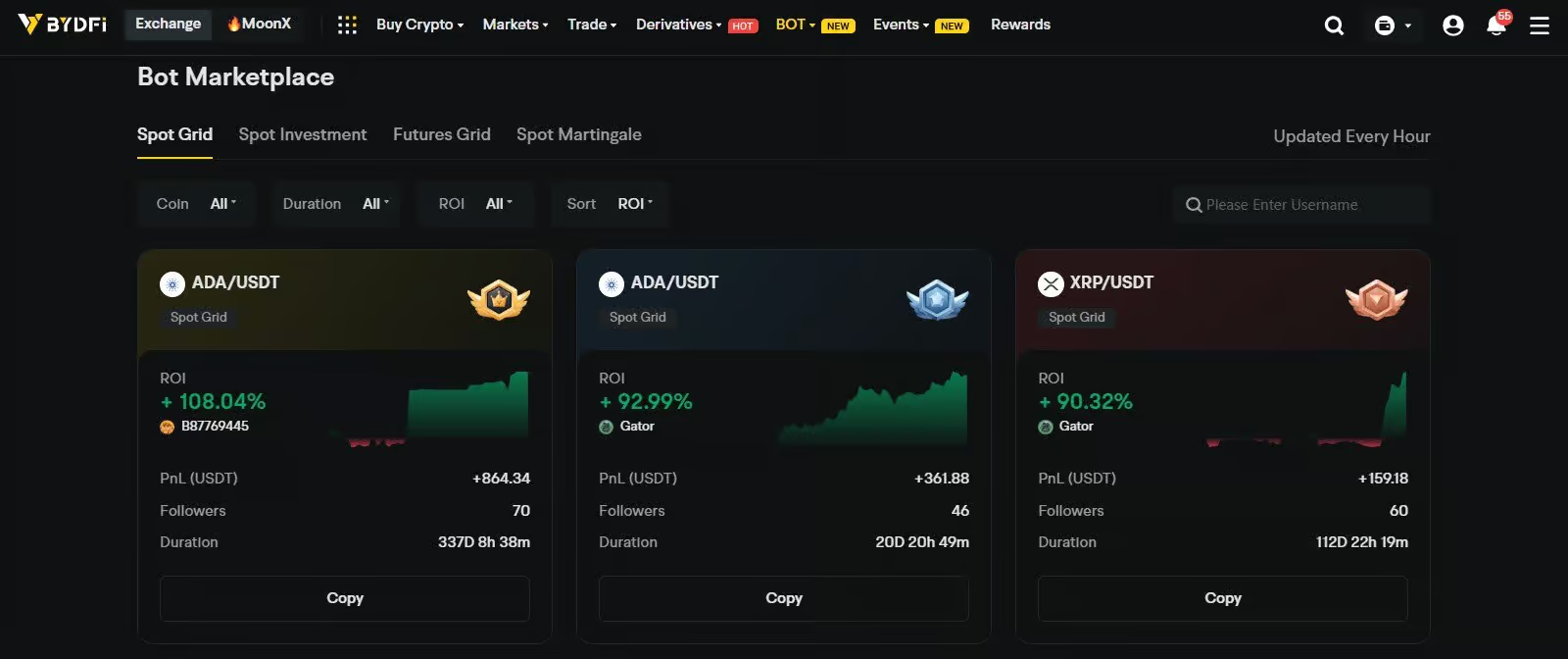

BYDFi supports automated trading through integrated trading bots. The specific bots available are:

- Grid Trading Bot

- Martingale Trading Bot

These bots allow users to automate strategies like buying low and selling high within a defined range (Grid) or averaging down positions (Martingale), operating 24/7 without manual intervention.

BYDFi Trading Fees

BYDFi employs a maker-taker fee model, which differentiates fees based on whether an order adds liquidity (maker) or removes liquidity (taker) from the market. The fee structure varies between spot and futures markets.

Spot Trading Fees

In the spot market, BYDFi offers a distinct fee schedule:

- Spot Maker Fee: 0.10%

- Spot Taker Fee: 0.10%

The zero-percent maker fee is highly advantageous for traders who place limit orders that are not immediately filled, as they pay no fee when their order adds liquidity to the book.

Futures Trading Fees

For futures (perpetual contracts), the fees are structured differently:

- Futures Maker Fee: 0.020%

- Futures Taker Fee: 0.060%

These fees are applied to the notional value of the position when trading derivatives.

Here is a summary of the trading fees:

| Market | Maker Fee | Taker Fee |

|---|---|---|

| Spot | 0.10% | 0.10% |

| Futures | 0.020% | 0.060% |

BYDFi Deposits & Withdrawals

BYDFi facilitates account funding through various methods but restricts withdrawals solely to cryptocurrencies. The platform supports several fiat currencies for initiating purchases via third-party integrations, including GBP, EUR, and USD, plus at least one other unspecified currency.

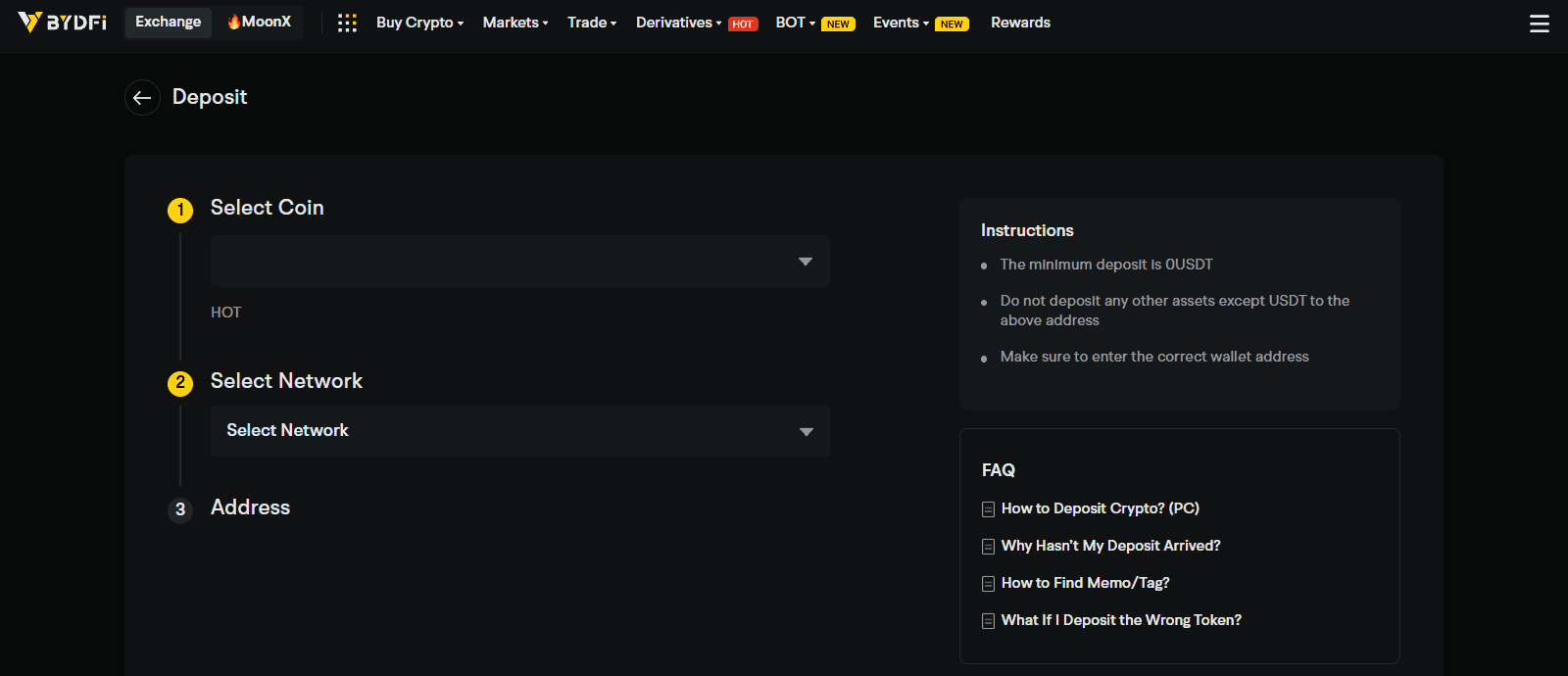

BYDFi Deposit Methods & Fees

Users can deposit funds into their BYDFi accounts using the following methods:

- Cryptocurrencies

- Credit Card (via third-party providers)

- Debit Card (via third-party providers)

- Bank Transfer (via third-party providers)

- SEPA (via third-party providers)

- Apple Pay (via third-party providers)

- Google Pay (via third-party providers)

- Third-party providers: Transak, Banxa, Alchemy Pay, Coinify, Mercuryo

Fees for these deposit methods are not specified by BYDFi. Generally, direct cryptocurrency deposits to exchanges are free, excluding network fees. However, using third-party services for fiat-to-crypto purchases (like Credit Card, Bank Transfer, SEPA via providers like Banxa or Transak) typically involves fees charged by the payment processor, not BYDFi itself. Users should verify these external fees before initiating a deposit.

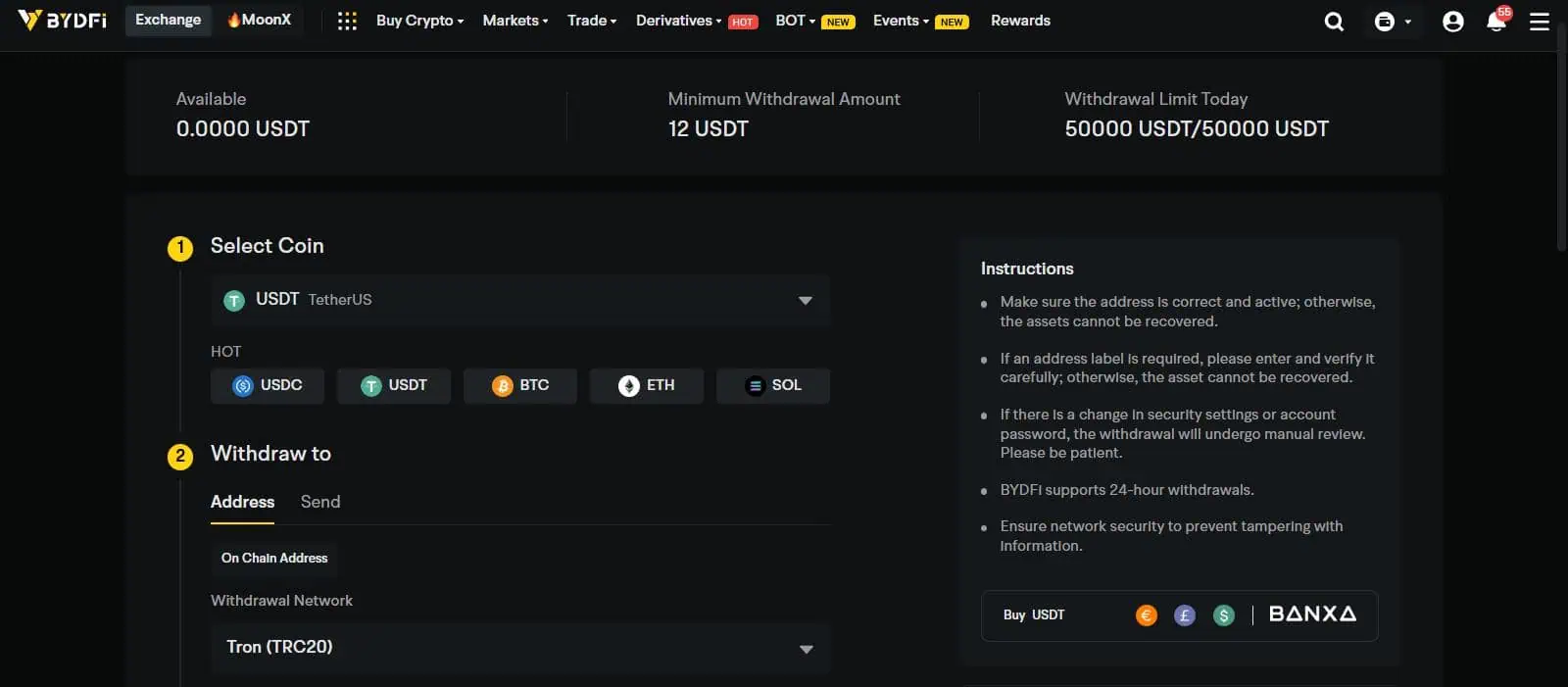

BYDFi Withdrawal Methods & Fees

Withdrawals from BYDFi are limited to:

- Cryptocurrencies

Direct withdrawals to bank accounts or via fiat methods are not supported. When withdrawing cryptocurrencies, users will incur network fees, which vary depending on the specific coin and the blockchain’s congestion level. BYDFi does not specify fixed withdrawal fees, as these are primarily determined by the underlying blockchain network. Withdrawal limits depend on KYC status: 1 BTC daily without KYC, and 1.5 BTC daily with Level 1 KYC or higher.

BYDFi Customer Support

BYDFi provides customer support through primary channels to assist users with inquiries or issues. Support options include:

- 24/7 Live chat

- Email support

BYDFi received a customer support rating of 8 out of 10, suggesting a generally positive user experience with the support services offered. Support is expected to be available primarily in English, aligning with the website language.

BYDFi Security & Regulations

Assessing the security and regulatory standing of a cryptocurrency exchange is crucial for users. BYDFi is rated as having an “Above Average” safety index.

Exchange Security & Regulations

While headquartered potentially in Singapore, BYDFi holds registrations in other jurisdictions. Online research indicates BYDFi (or its operating entities) is registered as a Money Service Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) in the United States and with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). These registrations impose certain compliance requirements, particularly concerning anti-money laundering (AML) and counter-terrorist financing (CTF) standards, even though the platform offers no-KYC basic access. The lack of mandatory KYC for all users can sometimes be viewed as a potential risk by regulators, although it is a key feature for many users. Users should be aware of the regulatory landscape applicable to their own jurisdiction when using any exchange.

Account Security

To protect user accounts, BYDFi is expected to implement standard security measures. These typically include:

- Two-Factor Authentication (2FA): Using methods like Google Authenticator or SMS codes to secure logins and withdrawals.

- Cold Storage: Keeping a significant portion of user funds offline to prevent theft from hot wallets.

- Withdrawal Whitelists: Allowing withdrawals only to pre-approved addresses.

- Regular Security Audits: Reputable exchanges often undergo audits.

Users are always encouraged to enable all available security features, particularly 2FA, to protect their accounts.

Conclusion

BYDFi presents itself as a compelling option for specific types of cryptocurrency traders, particularly those prioritizing privacy and high leverage. Established in 2019, the platform supports a wide array of assets, with 324+ cryptocurrencies for spot trading and 480+ futures contracts. Its key differentiator is the absence of mandatory KYC for basic use, coupled with very high futures leverage up to 200x. The trading fee structure, especially the 0.10% spot maker fee, is advantageous for liquidity providers. Futures fees (0.02% maker / 0.06% taker) are competitive. Available Grid and Martingale bots cater to automated trading enthusiasts.

However, potential users must consider the drawbacks. The spot market volume ($211.71M) is relatively low compared to its strong futures market ($5.6B). The most significant limitation is the lack of direct fiat withdrawal options; users can only withdraw cryptocurrencies. Furthermore, access is restricted for residents of several countries, including the UK and China. While the no-KYC policy is a benefit for some, it might raise security or regulatory concerns for others. BYDFi seems best suited for experienced derivatives traders comfortable with high leverage and users specifically seeking a no-KYC trading environment.

FAQ

Q: Is KYC required to use BYDFi?

No, mandatory KYC is not required for basic trading and withdrawals up to 1 BTC per day. Completing Level 1 KYC increases the daily withdrawal limit to 1.5 BTC.

Q: What are the trading fees on BYDFi?

The fees at BYDFi are:

- Spot Trading: 0.10% Maker Fee / 0.10% Taker Fee

- Futures Trading: 0.020% Maker Fee / 0.060% Taker Fee

Q: What is the maximum leverage available on BYDFi?

BYDFi offers a maximum leverage of up to 200x for futures trading.

Q: Can I deposit and withdraw fiat currency (like USD, EUR) on BYDFi?

You can deposit fiat via third-party providers (like credit card, bank transfer through services like Banxa, Transak) to buy crypto. However, BYDFi only supports cryptocurrency withdrawals; direct fiat withdrawals are not available.

Q: Does BYDFi offer trading bots?

Yes, BYDFi offers Grid and Martingale trading bots for automated trading strategies.