Summary

Cryptoregulation in India has had its ups and downs, but over the years, we’ve seen several exchanges emerge, allowing Indian users to buy and sell cryptocurrencies with ease. To buy Tether (USDT) in India, some notable exchanges include CoinDCX, Binance, and WazirX. These platforms not only strictly adhere to regulations to protect their users but also offer easy-to-use interfaces, making the journey from buying to trading much more seamless.

Can I Buy Tether (USDT) in India?

Yes, you can buy Tether (USDT) in India, with the added convenience of using INR to deposit funds directly to your exchange via your bank account. Local exchanges like CoinDCX and WazirX offer on-ramp services, enabling users in India to buy Tether (USDT) or other cryptocurrencies with ease. Additionally, platforms like Binance provide P2P options, allowing Indian users to buy and sell crypto using local payment methods for added flexibility.

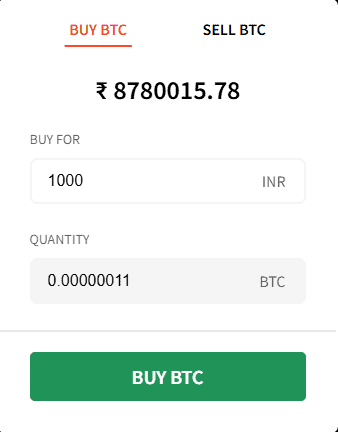

How to Buy Tether (USDT) in India Using CoinDCX

CoinDCX, trusted by over 1.6 Cr+ Indians, is an excellent choice to buy Tether (USDT) in India. As one of the top exchanges in India, it supports over 322 cryptocurrencies and offers leverage of up to 25X. The platform provides free INR deposits and withdrawals, spot trading fees of 0.50%, and futures fees of 0.021%/0.064%. CoinDCX also offers up to ₹100 in bonuses and a mobile app for convenient trading. With ISO/IEC 27001:2022 certification, 24/7 live chat support, and automated tax reports, it ensures a secure and user-friendly experience for Indian traders.

Best Alternatives to CoinDCX for Buying Tether

Exchanges might face temporary downtimes, or you may want a secondary platform for extra security. In such situations, consider these alternatives to purchase Tether (USDT) in India.

Binance

Binance is not only a global leader in cryptocurrency exchanges but also caters specifically to Indian users. The platform allows seamless crypto purchases in INR, with local payment methods like PhonePe for easy transactions. Binance supports a wide range of services, from P2P trading to staking and lending, making it a one-stop platform for both beginners and advanced traders. Its low trading fees, along with advanced tools and high leverage options, make Binance a top choice for crypto enthusiasts worldwide.

WazirX

WazirX has become a prominent player in India’s crypto market, serving over 15 million users. The exchange is known for its user-friendly features such as QuickBuy, which simplifies the crypto purchase process. WazirX’s high liquidity ensures quick and efficient transactions, making it an ideal choice for Indian users looking to buy Tether (USDT) in India. With a focus on security, it offers 2FA and encryption for added protection. While the platform doesn’t support futures trading, its easy-to-use interface and multilingual 24/7 support make it accessible for users at all levels.

INR to USDT Fees

Purchasing Tether (USDT) with INR on centralized exchanges usually does not incur any fees because these exchanges typically offer free deposits and withdrawals. However, if you’re looking to buy Tether (USDT) in India using a P2P platform, you might end up paying a higher price. Although there are no fixed fees, the rates can vary due to the lack of regulations.

Is Tether (USDT) Legal in India?

In India, Tether (USDT) is legal, and people can buy and sell it on various cryptocurrency exchanges. The government has introduced a tax regime for crypto transactions, where profits from trading are taxed at 30%. While there isn’t an outright ban on cryptocurrencies, the regulatory framework is still evolving. This shows that the government is taking a cautious yet open approach to digital currencies, including Tether. Users are advised to comply with tax requirements while engaging in crypto activities.

Bottomline

Tether (USDT) is legal to buy and sell in India, with exchanges like CoinDCX, Binance, and WazirX providing easy access for transactions. However, it’s important to comply with the country’s 30% tax on crypto profits. While regulations are still evolving, the government has not banned cryptocurrencies, indicating a cautious yet open stance towards digital assets like Tether.

FAQs

1. Do I need to complete KYC to buy Tether (USDT) in India?

Yes, most exchanges in India, including CoinDCX and WazirX, require users to complete a KYC process before trading. This is to ensure compliance with regulations and enhance security.

2. What payment methods can I use to buy Tether (USDT) in India?

Indian users can buy USDT using various payment methods such as UPI, bank transfers, debit/credit cards, and P2P payment systems like PhonePe.

3. Can I store Tether (USDT) in my exchange wallet?

Yes, exchanges like CoinDCX, WazirX, and Binance allow you to store USDT in their wallets. However, for better security, consider transferring your funds to a private wallet.

4. Are there any transaction fees for converting INR to USDT?

While many Indian exchanges offer free INR deposits, some may charge small trading fees (e.g., WazirX charges 0.2%). Always check the fee structure of your chosen platform.

5. Does India’s 30% crypto tax apply to Tether (USDT)?

Yes, if you sell USDT at a profit, the 30% crypto tax applies. You must report these gains while filing your income tax returns.