Summary

Can I Buy Bitcoin with Volksbank?

The short answer is: Yes, but not directly through most Volksbank branches.

Volksbank is a prominent banking institution in Germany, serving over 18 million customers as part of the Volksbanken Raiffeisenbanken Group, a decentralized network of cooperative banks. This structure means that each branch has its own policies regarding cryptocurrencies.

For instance, Volksbank Mittweida gives its customers access to digitized bonds on the Polygon network, in partnership with Swarm Market. Similarly, Volksbank Raiffeisenbank Bayern Mitte has partnered with the Austria State Printing House to offer a Bitcoin cold wallet, called VR-BitcoinGoCard, to its customers. With this wallet, customers can buy, trade, and securely store Bitcoin through their online banking platform.

However, these offerings are not yet available across all Volksbank branches. Despite this, Volksbank customers in Germany can easily buy Bitcoin and other cryptocurrencies through BaFin-regulated exchanges like Bitpanda.

How to Buy Crypto with Volksbank on Bitpanda

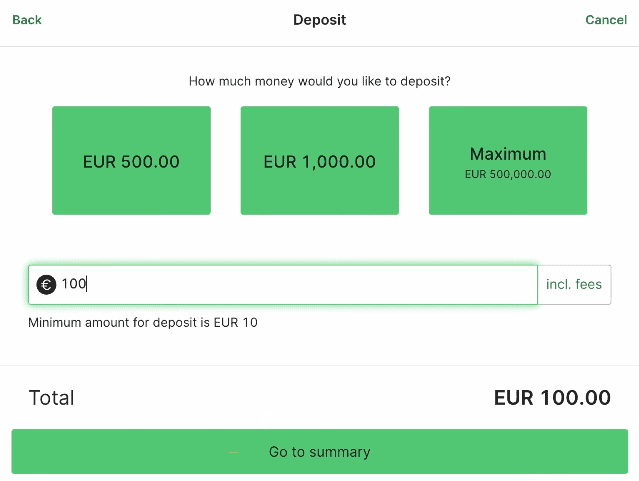

If your Volksbank branch doesn’t offer cryptocurrency services, you can easily switch to third-party exchanges like Bitpanda. Established in 2014, Bitpanda is a highly secure platform with over 4 million users. It complies with German crypto regulations, ensuring strict adherence to anti-money laundering (AML) and KYC policies. Bitpanda offers access to over 210 cryptocurrencies and supports a variety of payment methods, including credit card, debit card, bank transfer, and SEPA.

Users can buy crypto with Volksbank using either direct bank deposits, where they will receive PayID for transferring funds, or by using their credit/debit cards to make the purchase.

Where Volksbank Customers Can Buy Crypto

Bitpanda has its perks, but there are some drawbacks as well, which may not sit well with some. In such cases, alternatives like Bitget and BingX can be considered.

Bitget

Founded in 2018, Bitget offers a high level of security and has over 8 million users.With mandatory KYC, Bitget supports 871+ spot cryptocurrencies and 246+ futures contracts, with leverage up to 125x. Bitget also accepts payments via credit card, debit card, bank transfer, SEPA, and third-party platforms like Apple Pay and Google Pay.

BingX

BingX is another excellent alternative for Volksbank customers looking to switch. It supports deposits via credit card, debit card, MoonPay, Mercuryo, UnionPay, bank transfer, and SEPA. Founded in 2018 by Josh Lu, BingX has amassed over 5 million users. The platform offers 824+ spot cryptocurrencies, 246+ futures contracts, and leverage up to 200x.

What are the Fees?

For Volksbank customers looking to invest in Bitcoin and other cryptocurrencies, it’s important to factor in additional costs such as deposit and withdrawal fees, trading commissions, and spreads. Choosing a trading platform that aligns with your budget is essential for maximizing investment returns.

Bitpanda charges no fees on SEPA transfers, and the transfers are instant. However, for Mastercard/Visa card payments, Bitpanda imposes a 1.80% fee. While Bitpanda is a convenient option, other cryptocurrency exchanges in Germany may offer more competitive fees for buying Tether or other cryptocurrencies.

Volksbank Cryptocurrency Policy

Volksbank has actively engaged with cryptocurrency, offering services such as Bitcoin trading through its online banking platform. Volksbank Raiffeisenbank Bayern Mitte provides a secure cold wallet solution, the VR-BitcoinGoCard, for Bitcoin storage. Volksbank Mittweida focuses on educating customers about blockchain and offering tokenized bonds.

Despite these initiatives, some branches have been cautious, with reports of account closures following Bitcoin transactions. The bank’s cryptocurrency policy is a blend of innovation and caution, with a focus on security and customer education.

Bottomline

While Volksbank doesn’t directly facilitate cryptocurrency purchases, some branches provide limited services such as Bitcoin trading and secure cold wallets. Customers can still access crypto trading via third-party platforms such as Bitpanda, Bitget, and BingX. While there are benefits to these platforms, users should also consider the associated fees and the platforms’ security features. As regulations evolve, Volksbank’s cryptocurrency policies may adapt to meet customer needs.

FAQs

1. Why does cryptocurrency policy vary between Volksbank branches?

Volksbank operates as a decentralized network, allowing branches to decide their offerings. Some branches embrace crypto, while others remain cautious.

2. Is the VR-BitcoinGoCard available at all Volksbank branches?

No, the VR-BitcoinGoCard is currently offered by select branches, such as Volksbank Raiffeisenbank Bayern Mitte.

3. Can I link my Volksbank account to multiple crypto exchanges?

Yes, you can link your account to multiple BaFin-regulated exchanges, provided you comply with AML and KYC policies.

4. Are there transaction limits when using Volksbank for crypto purchases?

Transaction limits depend on your account type and the exchange platform’s policies. Check with both Volksbank and your chosen exchange.

5. How is cryptocurrency taxed in Germany?

In Germany, crypto held for over one year is tax-free for individuals. However, profits from crypto held for less than a year are subject to income tax. Ensure accurate reporting to avoid penalties.