Summary

Synchrony Bank customers can buy and sell cryptocurrencies like Bitcoin or Ethereum using their Synchrony Bank accounts, but indirectly. Synchrony Bank does not directly handle crypto transactions. However, to buy crypto with Synchrony Bank, customers can easily fund their accounts on FinCEN-regulated exchanges like BloFin in the United States.

Can I Buy Bitcoin with the Synchrony Bank?

Yes, Synchrony Bank customers can buy Bitcoin, though not directly. Synchrony Bank enables its users to fund accounts on FinCEN-regulated crypto exchanges such as BloFin. These platforms provide a safe and regulated space for purchasing Bitcoin and other cryptocurrencies. While Synchrony Bank itself doesn’t handle crypto, its streamlined banking services ensure easy transactions on approved exchanges.

How to Buy Crypto with Synchrony Bank on BloFin

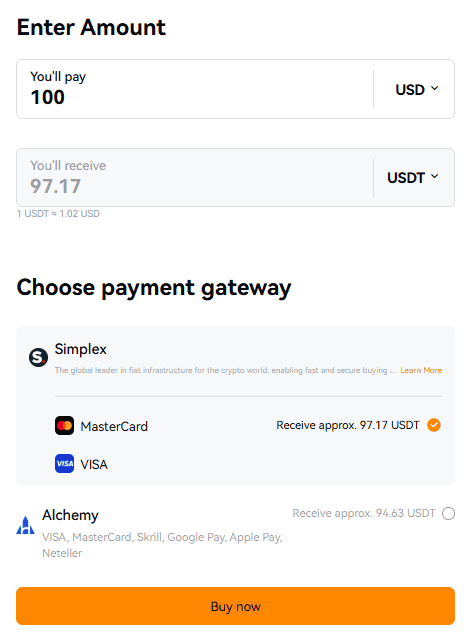

For Synchrony Bank customers looking to buy crypto using USD fiat deposits, Blofin offers a seamless and secure experience. Launched in 2019, Blofin allows users to trade a wide range of cryptocurrencies with a focus on ease of use and high leverage, offering up to 150x. The platform supports various payment methods, including credit cards, Google Pay, and Apple Pay, and doesn’t require KYC, providing added privacy for users. Blofin’s low fees and the option to use multiple payment methods make it a versatile option. Primarily designed for those looking to trade with high leverage and straightforward crypto transactions, BloFin can be a great option for US users to begin their trading journey.

Here is how you can buy crypto with Synchrony Bank on BloFin:

Alternatives to BloFin

Having backup options is valuable, particularly with exchanges, as certain cryptocurrencies may not be accessible on BloFin. You can always explore other reliable platforms to purchase crypto with Synchrony Bank.

Coinbase

Coinbase is a secure platform for Synchrony Bank customers to buy crypto with USD fiat deposits and is amongst the best crypto exchanges in USA. It offers 250+ cryptocurrencies, supports credit/debit cards, and requires KYC. While it’s ideal for beginners, its higher fees and limited advanced features make it best for passive investors.

Kraken

Kraken is a reliable platform for Synchrony Bank customers to buy crypto with USD fiat deposits. It offers 323+ cryptocurrencies and supports credit/debit cards. KYC is required, and the platform provides up to 50x leverage. Trusted by 9+ million users worldwide, Kraken is a regulated and secure exchange, making it an excellent choice for Synchrony Bank customers looking to buy crypto.

What are the Fees?

Synchrony Bank does not charge fees for online debit card payments when purchasing cryptocurrency on a registered centralized exchange. However, the fees for credit card transactions can vary depending on the account type and credit score of the customer.

Synchrony Bank Cryptocurrency Policy

Synchrony Bank does not offer direct cryptocurrency services, but it enables customers to transfer funds to regulated crypto exchanges. These exchanges must be registered as Money Services Businesses (MSBs) with FinCEN.

Although Synchrony Bank supports cryptocurrency transactions, customers should check the bank’s policies and FAQs to ensure there are no limitations on transferring funds to or from these platforms.

Bottomline

Synchrony Bank enables users to buy crypto, but indirectly. To ensure a smooth transaction, it’s essential to use an exchange registered with FinCEN. Centralized platforms like BloFin, Coinbase, and Kraken make the process easier with user-friendly interfaces and straightforward onboarding, allowing for hassle-free crypto purchases.

FAQs

1. Can I use my Synchrony Bank credit card to buy crypto?

Yes, you can use your Synchrony Bank credit card to purchase cryptocurrency on FinCEN-regulated exchanges. However, some exchanges may charge higher fees for credit card transactions compared to debit cards or bank transfers. Additionally, check with Synchrony Bank for any applicable cash advance fees or restrictions.

2. Are there any restrictions from Synchrony Bank on funding crypto exchanges?

Synchrony Bank typically allows transactions to regulated crypto exchanges, but it’s recommended to verify with customer support. Some policies might vary depending on the exchange or the region.

3. What happens if my Synchrony Bank transaction to a crypto exchange is declined?

If your transaction is declined, it could be due to transaction limits, flagged activity, or an unsupported exchange. Contact Synchrony Bank’s customer service to resolve the issue or ensure the exchange is FinCEN-registered and compliant with US regulations.

4. Does Synchrony Bank provide any crypto rewards or incentives?

No, Synchrony Bank doesn’t currently offer any crypto-related rewards or incentives. However, their credit card partnerships may provide cashback or points that you can use toward crypto purchases on supported platforms.

5. Can I sell crypto and transfer the funds back to my Synchrony Bank account?

Yes, you can sell cryptocurrency on regulated exchanges and withdraw the funds to your Synchrony Bank account via bank transfer. Ensure the exchange supports USD withdrawals and matches the details of your bank account for seamless processing.