Summary

Can I Buy Bitcoin with the Swedbank?

Buying Bitcoin with Swedbank is simple. Although Swedbank doesn’t allow direct crypto purchases, you can still use your Swedbank debit or credit card, or link your account to buy digital assets on exchanges like BloFin and Bybit.

While cryptocurrency is not considered legal tender in Sweden, buying, selling, and trading digital assets is fully permitted under Swedish regulations.

How to Buy Crypto with Swedbank on BloFin

BloFin, founded in 2019 by Matt Hu, is a cryptocurrency exchange with over 2 million users. It offers both spot and futures trading with leverage up to 150x. Known for its competitive fees, including a spot maker fee of 0.10% and a futures maker fee of 0.02%, BloFin supports a wide range of cryptocurrencies. The platform allows users to trade in SEK and EUR, making it a suitable choice for Swedish users. BloFin also features no KYC requirements, providing an accessible trading experience for users in various regions.

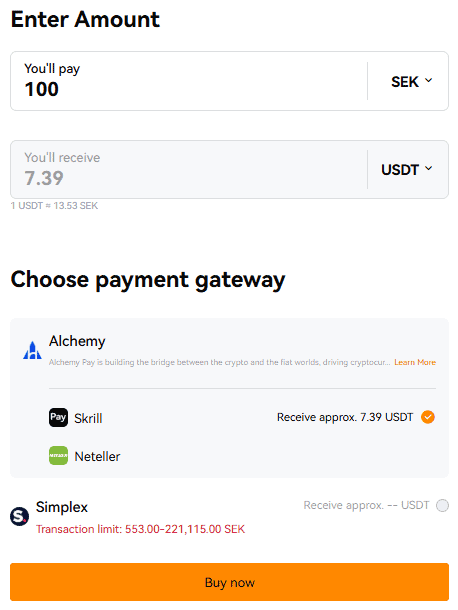

Here’s how Swedbank users can buy crypto with Swedbank accounts on Blofin:

Alternatives to BloFin

Let’s take a look at some alternatives to BloFin that are supported by Swedbank.

Bybit

Bybit, founded in 2018 by Ben Zhou, has quickly become a popular choice for crypto traders, now with over 30 million users. It offers both spot and futures trading, with leverage up to 100x and competitive fees, including a spot maker fee of just 0.10% and a futures maker fee of 0.02%. While Bybit supports EUR, it doesn’t currently accept Swedish Krone (SEK), though it’s still available to users in Sweden.

To get started, you’ll need to complete KYC verification. Known for its user-friendly interface and strong liquidity, Bybit also offers advanced features like grid, martingale, and copy trading bots, making it an appealing platform for traders.

BingX

BingX, founded in 2018 by Josh Lu and Jack Lee, is a popular cryptocurrency exchange with over 5 million users. Based in Singapore, it offers spot and futures trading with up to 200x leverage and low fees, including a spot maker fee of 0.10% and a futures maker fee of 0.02%. With support for a wide range of cryptocurrencies, BingX also features grid trading and copy trading, making it a strong choice for traders seeking high leverage and advanced tools.

What are the Fees?

Swedbank does not charge any extra fees specifically for using credit or debit cards for online transactions on cryptocurrency platforms, but their standard card usage fees may apply.

Exchanges like Blofin, Bybit, or BingX do not impose platform-specific fees when purchasing cryptocurrency. However, payment gateways used during the transaction may have their own fees, which can vary depending on the method chosen. Always check the payment gateway’s fees before confirming your purchase.

Swedbank Cryptocurrency Policy

Swedbank doesn’t restrict customers from depositing or withdrawing funds to and from regulated cryptocurrency exchanges. However, they don’t provide specific information about cryptocurrencies on their official website. Their main focus seems to be on following strict Anti-Money Laundering (AML) and Know Your Customer (KYC) rules.

By not offering direct crypto trading, Swedbank aims to reduce the risks tied to money laundering and terrorist financing. That said, customers still have the flexibility to manage their crypto investments by interacting with regulated exchanges, all while staying compliant with financial regulations.

Is Cryptocurrency Legal in Sweden?

Yes, cryptocurrency is legal in Sweden. While it is not recognized as legal tender, the buying, selling, and trading of digital assets like Bitcoin and Ethereum are fully permitted under Swedish regulations through exchanges that comply with Swedish regulatory standards. Sweden has established a clear regulatory framework for crypto activities, ensuring a secure environment for investors.

However, the Swedish Financial Supervisory Authority (Finansinspektionen) has raised concerns about financial instruments tied to crypto-assets, highlighting risks such as market volatility, lack of transparency, and potential misuse for illicit activities. The authority cautions retail investors against the complexity of these instruments. Regulatory oversight is provided by both the Swedish Financial Supervisory Authority and the Swedish Data Protection Agency, ensuring a safer environment for investors.

Bottom Line

While Swed bank does not directly offer cryptocurrency services on their platform, users can easily integrate their Swedbank account with centralized exchanges, making the process very straightforward. With options like BloFin, Bybit, and BingX, Swedish users can securely buy, sell, and trade cryptocurrencies. Be sure to check transaction fees and payment gateway charges before finalizing your purchase to ensure a smooth experience.

FAQs

1. Can I use Swedbank to directly buy cryptocurrency?

No, Swedbank does not offer a direct option to buy cryptocurrency. However, you can use your Swedbank debit/credit card or link your account to purchase digital assets on regulated exchanges like BloFin, Bybit, or BingX.

2. What are the best alternatives to BloFin for buying crypto with Swedbank?

If BloFin isn’t your preferred choice, you can consider Bybit and BingX. While Bybit supports EUR but not SEK, BingX offers advanced features like grid trading and copy trading with support for multiple cryptocurrencies.

3. Is using Swedbank for cryptocurrency transactions safe?

Yes, using Swedbank for transactions with regulated crypto exchanges is safe. Swedbank ensures compliance with AML and KYC policies, which helps reduce risks associated with fraudulent activities.

4. Does Swedbank restrict deposits or withdrawals to crypto exchanges?

No, Swedbank does not restrict its customers from depositing or withdrawing funds to or from regulated cryptocurrency exchanges, allowing users to manage their investments freely.

5. How is cryptocurrency taxed in Sweden?

Cryptocurrency gains are taxable in Sweden and must be reported to the Swedish Tax Agency (Skatteverket). Any profits from selling, trading, or using crypto to purchase goods or services are considered taxable income. You are required to calculate the capital gains or losses for each transaction and report them in your annual tax return.